CICC: What is the driving force for the change of game distribution channels?

This article comes from WeChat WeChat official account’s "Golden Touch" by Zhang Xueqing.

With the overall rise of the buying mode, the game distribution channel has undergone tremendous changes, and the traditional application store intermodal mode has encountered challenges. We believe that high-quality gamers have stronger bargaining power in the face of application stores, and their potential profits have room for improvement, and they are optimistic about the rapid development of content vertical channel distribution mode.

What is the driving force for the change of game distribution channels? It is a common understanding in the market that the distribution channel of games has changed from the traditional app store to the rapid rise of the buying market. In the process of changing the channel from the old to the new, the decline of the combined transport mode of app stores and the rise of the buying mode of media advertisements are two sides. The main reasons are as follows: 1) Due to the decline of traffic scale and the high share of the whole life cycle, it is increasingly difficult for app stores to exchange traffic resources for high water share as a game distribution channel; 2) The rise of new traffic platforms and the improvement of bidding transaction efficiency are also reflected in the rise of new channels for game distribution; 3) Under the trend of long life cycle operation and high-quality R&D, the bargaining ability of head R&D has been improved.

What are the challenges and opportunities faced by game makers in the buying market after entering the stage of national buying? Since 2020, the buying market has entered the era of national buying, and game manufacturers are facing challenges and opportunities. On the one hand, when big factories enter the market, the purchase amount becomes the standard for mobile game distribution, and the market competition intensifies; On the other hand, under the objective trend of fierce buying competition, the quality of products has become the ultimate factor to determine the buying effect, and the difference in buying efficiency reflects the difference in delivery ability, and the marketing idea of product-effect synergy has brought the accumulation of brand value of manufacturers. On the whole, the game manufacturers of R&D and transportation have gained a better competitive pattern with excellent product quality in the context of increasingly fierce buying competition.

What is the long-term impact on the development of the game industry after the rise of the buying market? In the domestic game market, we judge that, on the one hand, the advantages of R&D-integrated manufacturers will be extended to the bargaining power facing channels, and the profit margin of game manufacturers will be improved; Moreover, R&D companies will consider the traffic operation mode in the whole product life cycle to improve the product purchase effect. On the other hand, in the long run, we expect that the proportion of Android channel sharing is expected to gradually decline, and the vertical channel of content represented by TapTap will gain more favor from game manufacturers.

We believe that after the proportion of channel sharing decreases, game makers can bear a higher level of purchase expenses while getting a higher share, so as to gain more users and further improve the flowing ceiling. Benchmarking overseas markets, we found that the share of overseas game distribution channels is basically below 30%, and at present, channels and developers are still fighting to reduce the share of 30%. On the whole, under the background that the bargaining power of Android channel is gradually declining and the buying power of game manufacturers continues to improve, we believe that the trend of content is king will continue in the future, and game manufacturers with integrated head research and transportation are expected to improve their profit margin and expand their market share by virtue of quality games.

risk

The macroeconomic downturn affects entertainment spending, the progress of new online games is slow, the performance of online game products is less than expected, the progress of obtaining version numbers is less than expected, the progress of overseas market expansion is slower than expected, and the game industry policy risks.

Looking back on the past year, head manufacturers no longer stick to the original traditional distribution mode of intermodal channels in application stores, but have tried to strengthen the distribution of short videos and other media. At the same time, when high-quality new products are launched, there are endless negotiations with the Android app store. Game makers hope to adjust the traditional 5:5 to 3:7 (channel: games) on the new boutique tour to gain more income space. Focusing on these changes, this report attempts to answer three questions on the basis of the in-depth report "Decrypting Mobile Game Traffic Operation Mode" released in June 2019:

#1 What is the driving force for the change of game distribution channels?

It is a consensus of the market that the distribution channel of games has changed from the traditional app store to the rapid rise of the buying volume market. In the process of changing the channel from the old to the new, the decline of the intermodal mode of app stores and the rise of the buying volume mode of media advertisements are two sides, the main reasons are as follows:

The intermodal mode of application store is a traditional distribution mode in the era of the rise of mobile games. Its core logic is that the application store, as a game distribution channel, exchanges abundant traffic resources for water sharing. In the past, because the app store had almost irreplaceable traffic portal status, game developers actively or passively reached users through the app store at the expense of high streaming share (such as 50% of Android channels). However, in recent years, the decline in traffic and the high share of the whole life cycle have made the application store intermodal mode more and more unsustainable.

The rise of new traffic platforms and the improvement of bidding transaction efficiency are also reflected in the rise of new channels for game distribution. Game buying is essentially an effect advertisement, which can reach potential players and gain users by placing advertisements. Therefore, on the one hand, in terms of traffic scale, the scale of users of short video platforms represented by fast hand vibrato has expanded rapidly, forming a new traffic gathering place; On the other hand, in the business model, programmatic advertising technology has gradually optimized the advertising delivery, and the distribution efficiency of game purchases has been improved.

Under the trend of long life cycle operation and high-quality R&D, the bargaining ability of head R&D is improved. On the one hand, under the restriction of policy and version number, the supply of market products decreases, and the long-life operation of fine products becomes an industry trend; On the other hand, boutique games have their own traffic, and their dependence on application stores has decreased. At the same time, under the trend of long-term operation, the whole life cycle intermodal mode has excessively eroded the profits of game manufacturers.

#2 What are the challenges and opportunities faced by game makers in the buying market after entering the stage of nationwide buying?

Since 2020, the buying market has entered the era of universal buying, and game manufacturers have entered the buying market in an all-round way, facing challenges and opportunities. On the whole, the game manufacturers of R&D and transportation have gained a better competitive pattern with excellent product quality in the context of increasingly fierce buying competition.

Challenge: When big manufacturers enter the market, the purchase amount becomes the standard for mobile game distribution, and the market competition is intensified. Under the upsurge of national buying, the number of materials and games in the game buying market increased rapidly, but the concentration of participants began to increase. Tencent Netease and other big companies entered the market and occupied the main share of the buying market. In the dimension of competition, we observed that the cost of materials and customers increased, and the competition became fierce. In addition, in terms of product distribution, buying volume has brought about the decentralization of the game market and the clearing of tail games, and manufacturers have participated in the competition in diversified categories.

Opportunity: the weight of high-quality content is improved, and refined traffic operation improves efficiency. We found that high-quality content can pass through the lower CAC(Customer) without the application store channel.

Acquisition cost) to acquire users, resulting in a larger LTV(Life time).

Value, life cycle value). On the one hand, under the objective trend of fierce competition in buying quantity, the quality of products has become the ultimate factor to determine the effect of buying quantity; On the other hand, the core of buying volume is to better match CAC<V in the scene of larger traffic, and the difference of buying volume efficiency reflects the difference of putting capacity. In addition, there is a new growth engine in the buying volume model, that is, the marketing idea of product-effect synergy brings the accumulation of brand value. We have noticed that the purpose of the current game purchase is not only the promotion of a single product, but also the long-term shaping of the manufacturer’s brand.

#3 What is the long-term impact on the development of the game industry after the rise of the buying market?

In the domestic game market, we judge that the reform of game distribution channels will continue to have a far-reaching impact on the industrial chain: on the one hand, the advantages of R&D-integrated manufacturers will be extended to the bargaining power facing the channels, which will help improve the profit margin of game manufacturers; Moreover, developers should consider the influence of purchase quantity in the whole life cycle of the game, which is helpful to improve the effect of product purchase quantity. On the other hand, the proportion of distribution channels is expected to gradually decline in the long run, while the vertical channel of zero-divided content represented by TapTap is expected to develop rapidly.

We made a scenario hypothesis on the influencing factors and process of the decline of the domestic Android channel stream sharing. We believe that there are three factors influencing the negotiation of Android channel sharing: 1) the market share of mobile phone hardware manufacturers basically determines the bargaining power of channels, and product quality and brand power determine the bargaining power of game manufacturers; 2) Degree of collaboration: the degree of collaboration of Android channels, especially the attitude of hardcore alliance; 3) Substitute products: the substitution effect of buying volume market on channels.

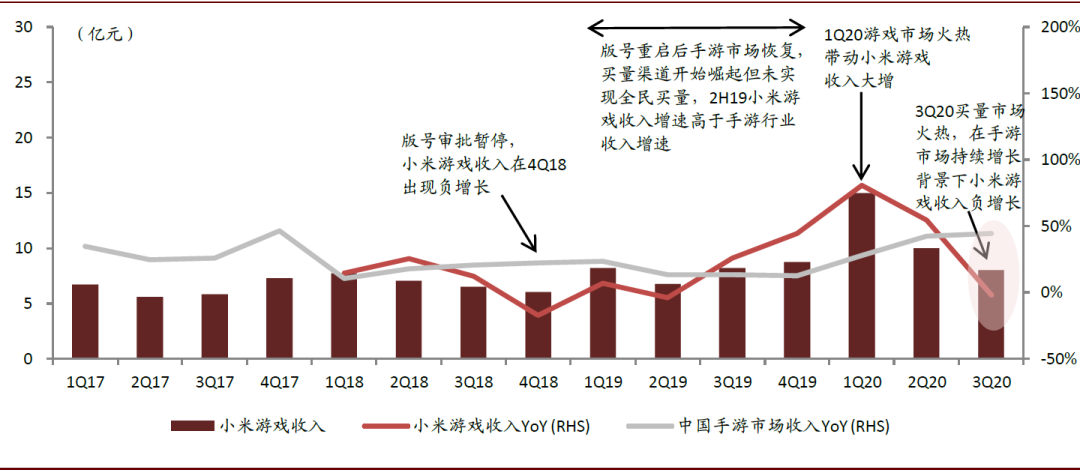

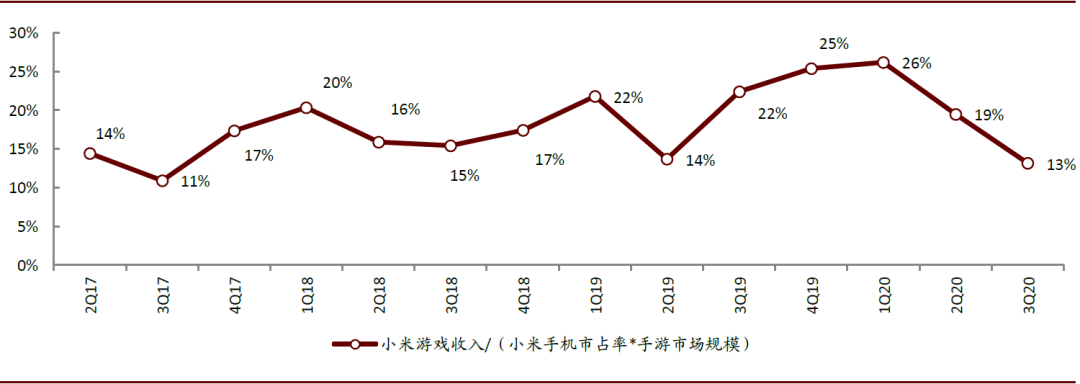

In particular, we compare the growth rate of Xiaomi game revenue and mobile game market revenue to illustrate the changing process of the strength comparison between channels and game manufacturers. 3Q20 Due to the hot buying market, there is a scissors gap in the income growth rate between the two parties. In the context of the continuous growth of the mobile game market, Xiaomi’s game revenue has experienced a negative growth, which reflects the influence of the national buying volume and the strength improvement of game manufacturers. Besides,

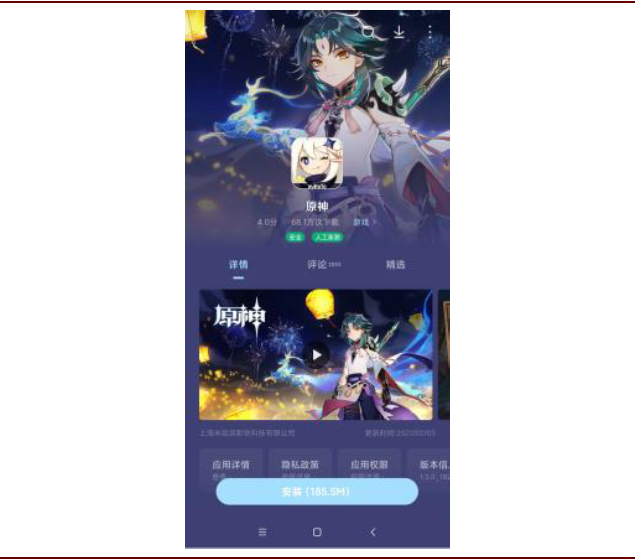

On February 3rd, 2020, Genshin Impact updated version 1.3 four months after its official release, and launched Xiaomi App Store for the first time, while the share of Genshin Impact and Xiaomi was 7:3. In addition, Xiaomi has provided Genshin Impact with promotional resources, including store opening advertisements, first-screen big pictures, and browser advertisement recommendation positions. On the first day, Genshin Impact downloaded more than 680,000 times in Xiaomi App Store.

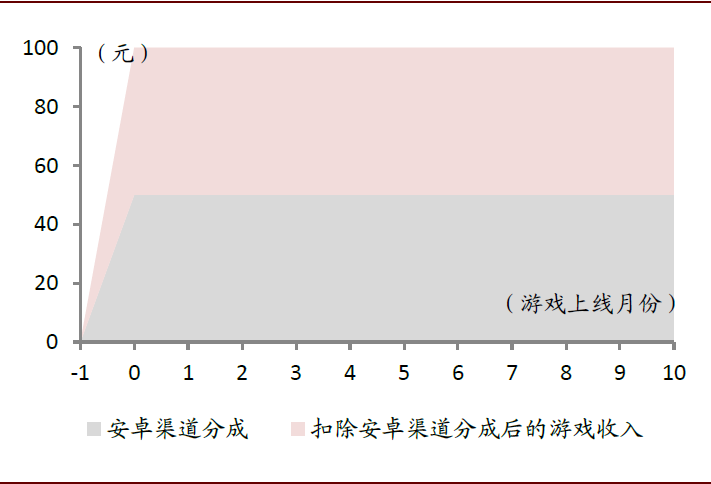

From the results, we take the distributable total flow of 100 yuan (after deducting channel fees, withholding taxes and fees, etc.) as an example to illustrate the influence of the change of channel sharing on the income of game manufacturers. Under the current situation that the Android channel is divided into 50%, game manufacturers can get 50 yuan income before deducting the purchase cost, but if the purchase cost is considered, the income will be lower. We calculate the revenue of game makers after deducting channel share and purchase cost when the proportion of channel share and purchase cost changes. In a neutral situation, if the share of Android channels is reduced to 30% and the purchase cost is 20%, the R&D and transportation integrated manufacturer can still get the income of 50 yuan. In addition, we believe that after the proportion of channel sharing decreases, game makers can bear a higher level of purchase expenses while getting a higher share, thus gaining more users and further improving the flowing ceiling.

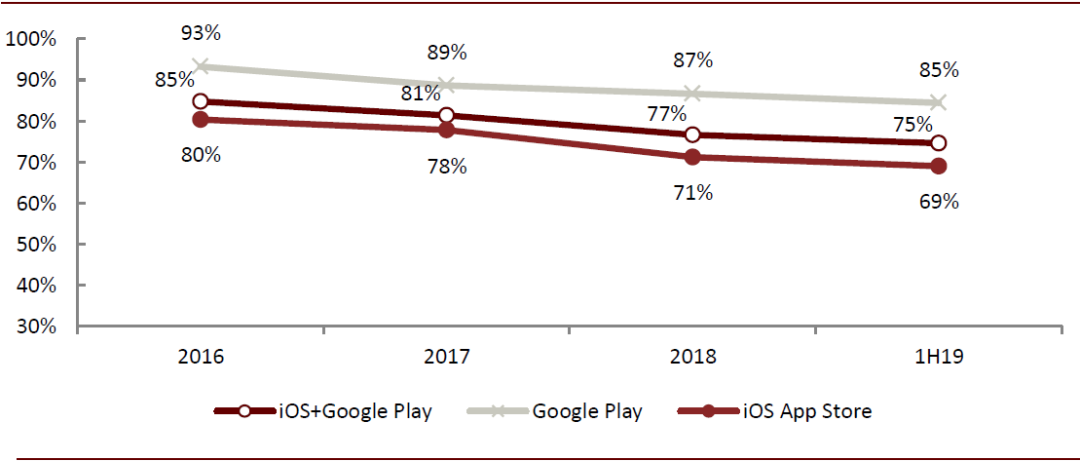

The debate about benchmarking overseas markets, channels and R&D companies is far from over, and the content is that the trend of king continues. On the issue of market share, we have counted the share of major game distribution channels in the world, and found that the share of overseas game channels is basically below 30%. At the same time, at present, channels and developers are still fighting each other, and Epic is still fighting with Apple to reduce the commission rate by 30%. We judge that the global debate between channels and R&D providers on sharing is far from over. From the trend of overseas markets, the content of Wanghui will continue, and high-quality content can not only bring rich benefits to developers, but also be an important escort cornerstone of the distribution platform.

From the old to the new, what is the driving force for the change of game distribution channels?

It is a common understanding of the market that the distribution channel of games has changed from the traditional app store to the rapid rise of the buying volume market. In the process of changing the channel from the old to the new, the decline of the intermodal mode of app stores and the rise of the buying volume mode of media advertisements are two sides.

We define the scope of discussion as follows:

Due to the closed system of iPhone and APPle, all apps must be downloaded from the App Store, and the commission ratio (commission

Rate) is 30%, which is not a controversial issue in the domestic game industry at present, so we only discuss the situation of Android app store in this article.

In the Android App Store, the sharing basis of game intermodal transportation is the total amount of running water after deducting 3%-5% of channel fees, withholding taxes and fees, etc. For the convenience of discussion and calculation, the sharing ratio of Android channels discussed in the following text is all running water after deducting the above fees.

#1 Disadvantages of the old channel: The mode that Android App Store traffic resources are exchanged for high water sharing is unsustainable.

The intermodal mode of application store is a traditional distribution mode in the era of the rise of mobile games. Its core logic is that the application store, as a game distribution channel, exchanges abundant traffic resources for water sharing. In the past, because the app store had almost irreplaceable traffic portal status, game developers actively or passively reached users through the app store at the expense of high streaming share (such as 50% of Android channels). However, in recent years, the decline in traffic and the high share of the whole life cycle have made the application store intermodal mode more and more unsustainable.

The growth rate of Android App Store users has slowed down, and the status of traffic portal has declined.

As a window for mobile phone users to download APPs, the app store has played an important role in the development and use of mobile phones for a long time, and thus gained the status of a near-monopoly traffic aggregation portal. However, since mid-2017, the traffic portal status of Android App Store has been challenged for three reasons, facing the decline of user growth rate and even the loss of users. First, the rise of two generations of super APPs, represented by Tencent and Tik Tok Aauto Quicker, has partially replaced the download portal function of the app store on the Android side, and users can directly click advertisements from some super apps and jump to the application official website to download. Second, the rise of new applications has slowed down, and the proportion of downloads caused by natural traffic has continued to decline. After the super APP forms a network effect and establishes a scale advantage, the behavior of downloading new APPs per mobile phone user becomes less frequent, and the access to the Android app store is no longer frequent. Third, the appearance of applets, H5 and other products makes it unnecessary for users to download apps.

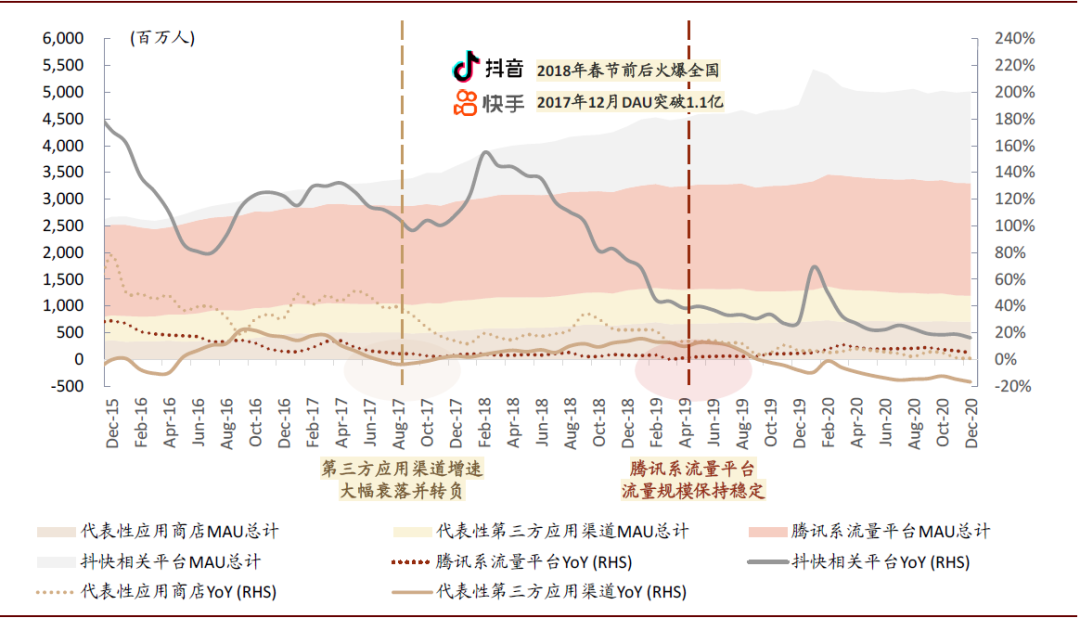

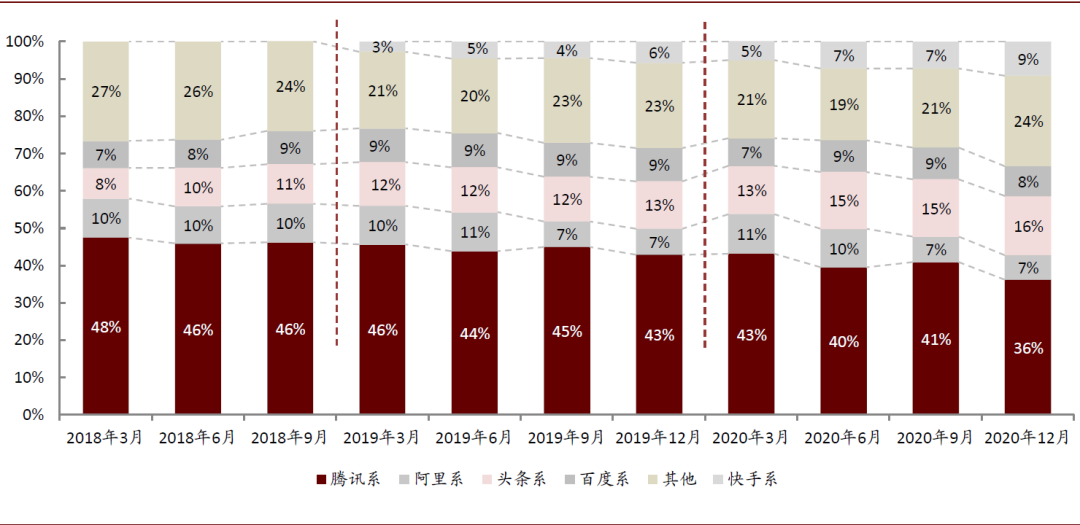

Chart: The traffic gathering place has experienced the shift from "App Store to Super App" and "Tencent Department to Fast Platform"

Source: QuestMobile, official website, Research Department of CICC.

Note: 1) The accumulation chart shows the total amount of MAU, and the curve shows the year-on-year growth rate of MAU; The ordinate axis in the diagram is the corresponding value of year-on-year growth rate, and the scale of MAU is only a relative indication, and the corresponding ordinate axis is not set;

2) Representative third-party application channels mainly include MAU ranking Top10 channels such as App Store, 360 Mobile Assistant, Baidu Mobile Assistant and PP Assistant; Tencent’s traffic platforms include WeChat, QQ, Watch Express, QQ space and QQ browser (the main channel for Guangdiantong); The fast-shaking platform includes short vibrato video, Tik Tok Extreme Edition, Tik Tok Volcano Edition, Watermelon Video, Today Headline, Aauto Quicker and Aauto Quicker Extreme Edition; Representative app stores mainly include hardcore alliance members and Xiaomi and Samsung app stores.

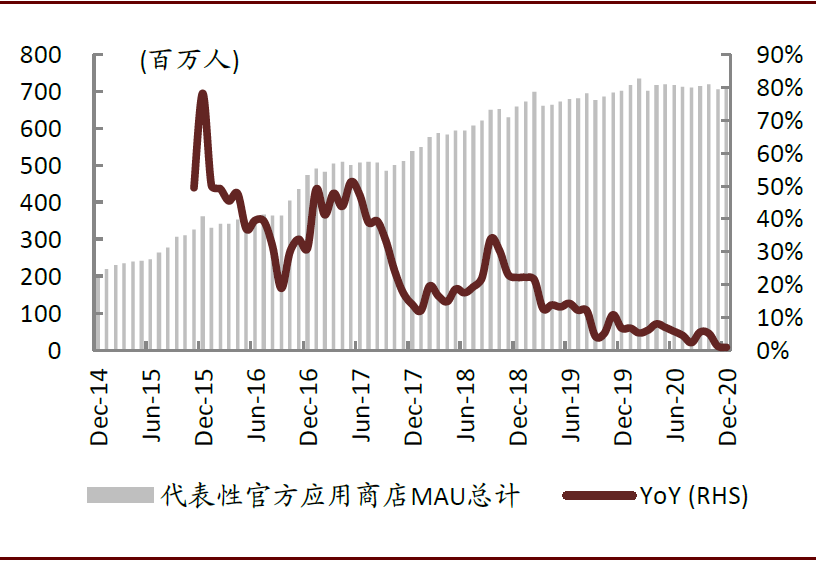

Chart: MAU, the official mobile app store, and its growth rate

Source: QuestMobile, Research Department of CICC.

Note: Statistical APP mainly includes hardcore alliance members (Huawei, OPPO, vivo, Meizu, ZTE, Coolpad, etc.) and Xiaomi and Samsung app stores.

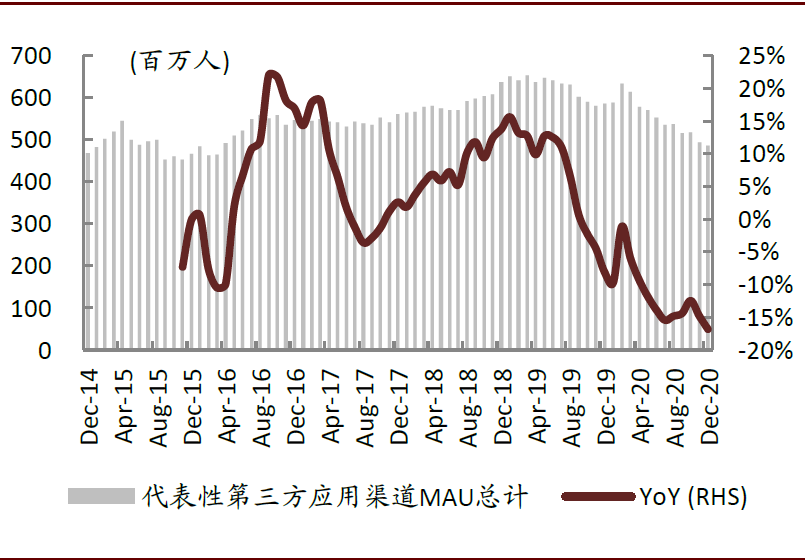

Chart: Top10 third-party application channel MAU and its growth rate

Source: QuestMobile, Research Department of CICC.

Note: According to the top ten third-party application channels App of QuestMobile, including AppBao, 360 Mobile Assistant, Baidu Mobile Assistant, PP Assistant, pea pods, Kuan, Anzhi Market and Google.

Play Store, Essential Apps, sogou Mobile Assistant

The high proportion of channel life cycle squeezes the profit space of game manufacturers.

The proportion of Android channel in the whole life cycle is too high. In the App store model, the channel share is 30%-50%, among which Apple App

Store commission ratio is 30%, and Android app store intermodal is divided into 50%. If we consider 1%~5% of channel fees, technical service fees, withholding taxes and fees, the actual share of Android channels exceeds 50%, while the share of developers is only 15%-30%. Considering the continuous improvement of the threshold of game research and development, the profit margin of game developers is very limited. Historically, 50% of the Android channel has not always existed. Before the establishment of the hardcore alliance in 2014, the division between game manufacturers and channels was always 7:3. After the establishment of hardcore alliances (OPPO, vivo, Coolpad, Gionee, Lenovo, Huawei, Meizu, Nubia) in 2014, hardware channels joined forces to demand a 50% share of the game stream.

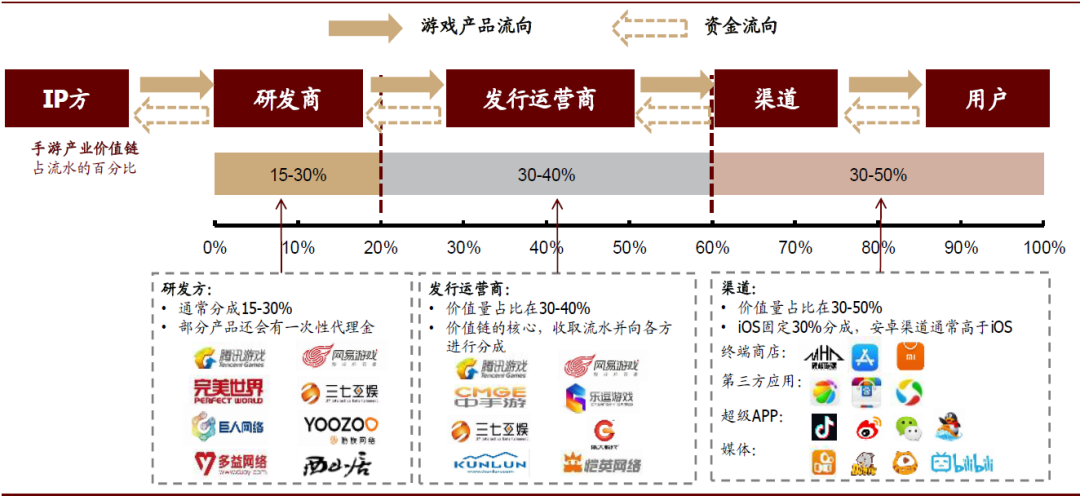

Chart: value chain of mobile game industry

Source: Company website, Research Department of CICC.

Note: The proportion of this punishment is based on the total amount that can be divided after deducting about 3%-5% of channel fees and withholding taxes.

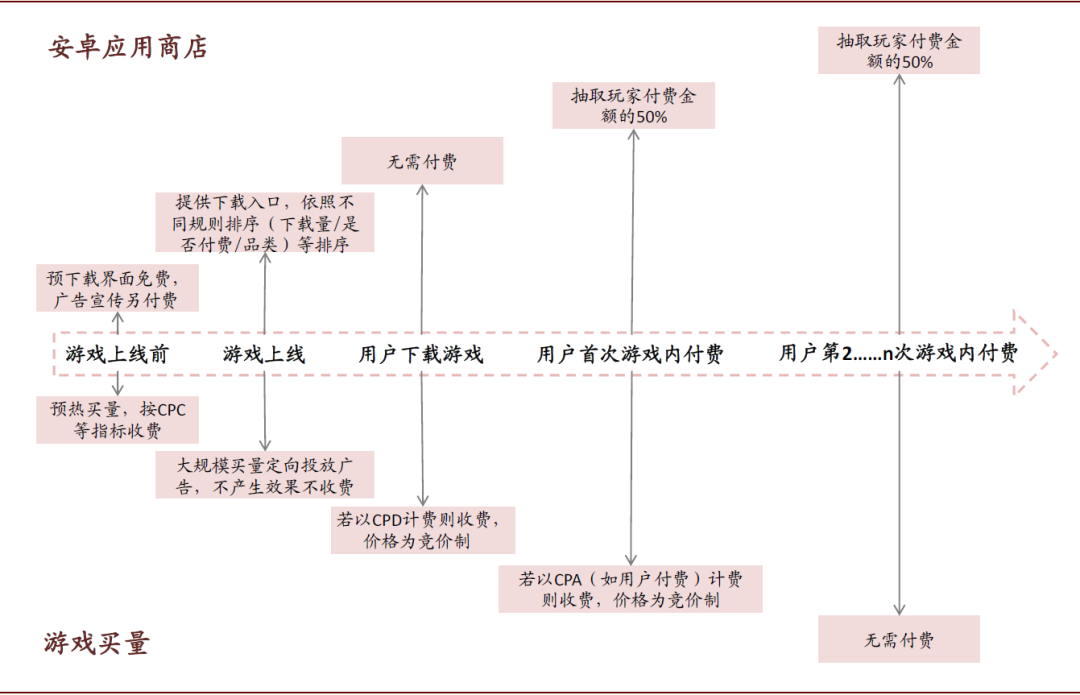

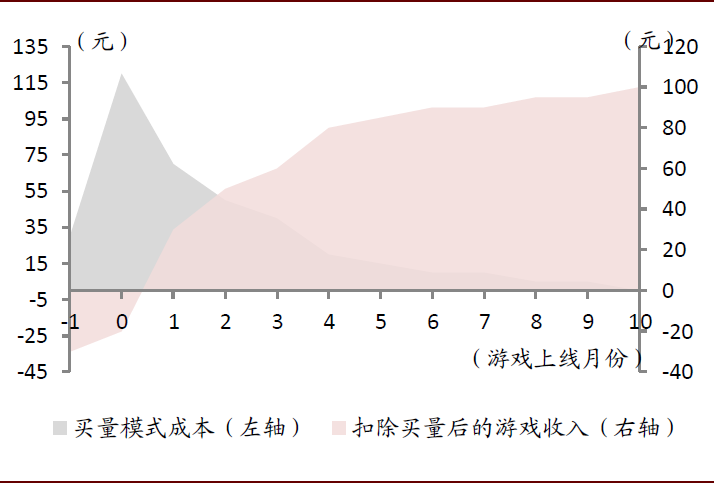

From the operational point of view, the double charging problem caused by the parallel connection of purchase volume and application store further erodes the profits of game manufacturers. In the current mode, considering that the app store still has important import value, most games will choose to pay equal attention to both the purchase volume and the combined transport of the app store, which may lead to double charges. From the perspective of the rationality of revenue sharing, under the trend of long-term operation of games, the short-term resource value brought by application stores has declined.

#2 The rise of new media: the change of traffic gathering places and the appearance of programmed advertisements have led to the rise of buying mode.

Game buying is essentially an effect advertisement, which can reach potential players and gain users by placing advertisements. Therefore, the rise of new traffic platforms and the improvement of bidding transaction efficiency are also reflected in the rise of new channels for game distribution.

In terms of traffic scale, the short video platform represented by fast hand vibrato has formed a new traffic gathering place.

From the perspective of the overall category change, the advertiser’s position moves with the change of traffic gathering place. If we consider the problem of game buying from the perspective of advertising, the scale of traffic is the premise. Therefore, the change of game distribution channel follows the change of traffic gathering place. From the distribution trend of Internet traffic in China, traffic gathering places have experienced the transformation from tool-based Baidu and app stores to social Weibo and WeChat, and then to content-based Tik Tok and Aauto Quicker. Behind the migration of traffic gathering places is the migration of user behavior habits and time allocation.

Chart: The proportion and change of the usage time of mobile Internet giant App-headline & the proportion of Aauto Quicker department has expanded rapidly.

Source: QuestMobile, Research Department of CICC.

Chart: echelon list of mobile game delivery channels in 2020

Source: Thermal Cloud Data, Research Department of CICC.

Note: In alphabetical order.

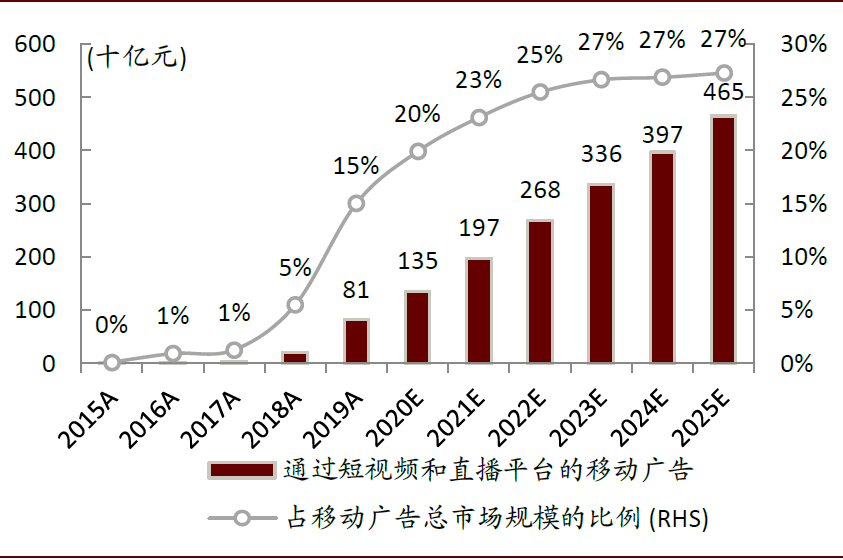

Gather short video and live broadcast markets, and its share in the advertising market continues to increase. According to Aauto Quicker’s prospectus, the mobile advertising scale of short video and live broadcast platforms has reached 81 billion yuan in 2019, accounting for 15% of the total mobile advertising market, and iResearch predicts that this proportion will reach 27% by 2025. We judge that the short video market with huge users and continuous growth will provide a broad market space for game purchases.

Chart: The scale and proportion of mobile advertising in China through short video and live broadcast platforms (in terms of revenue)

Source: Aauto Quicker prospectus, iResearch, Research Department of CICC.

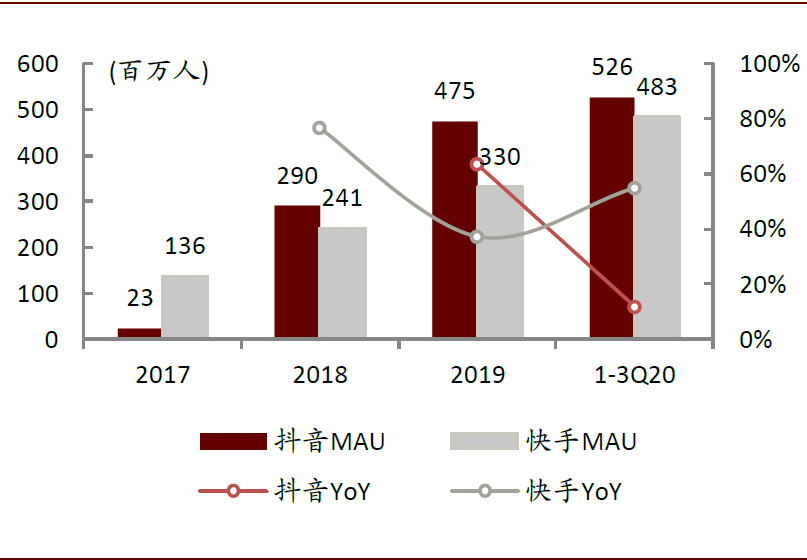

Chart: MAU scale and year-on-year growth rate in Tik Tok and Aauto Quicker

Source: Aauto Quicker prospectus, QuestMobile, Research Department of CICC.

Note: Due to the incoherence of official MAU data in Tik Tok. Here, the monthly average data of QuestMobile in the current year is used instead.

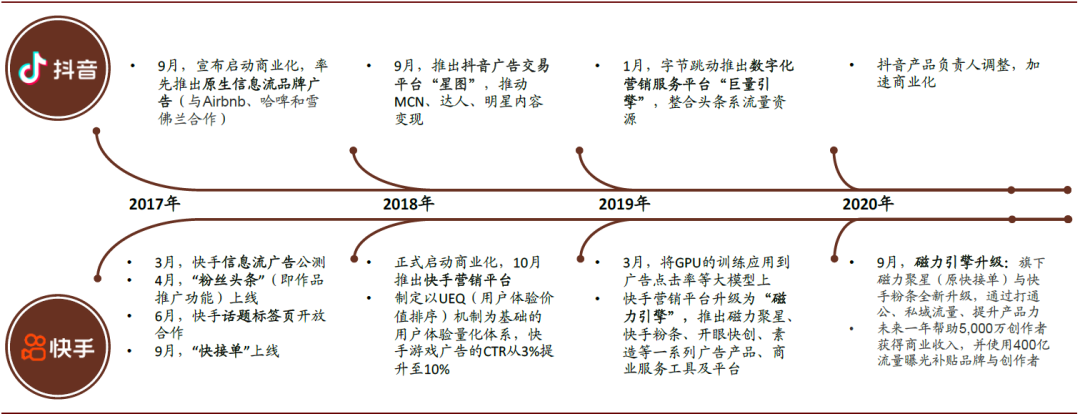

The monetization process of traffic on the buying platform has accelerated, releasing the buying space. We observed that before 2020, the monetization process of Aauto Quicker and Tik Tok short video platforms was not fast, but mainly focused on increasing the scale of users. By the end of 2019, after Tik Tok’s MAU exceeded 400 million and Aauto Quicker’s MAU reached 330 million, both sides accelerated the monetization speed. We expect that as the growth rate of users slows down gradually and the platforms enter a stable period, short video platforms such as Tik Tok and Aauto Quicker will continue to improve their monetization and provide more space for the purchase of games.

Chart: The course of advertising monetization in Tik Tok and Aauto Quicker.

Source: company announcement, LatePost, 36Kr, Annual Report of Magnetic Engine in 2019, Aauto Quicker Magnetic Engine Double Product Upgrade Conference, Research Department of CICC.

In the business model, the evolution of targeted technology and transaction forms has made it possible for thousands of people to advertise with different effects.

The rise of game buying is not only the expansion of traffic supply, but also the improvement of distribution efficiency. In terms of business model, programmatic advertising has gradually optimized advertising delivery in four aspects:

Optimization of delivery mode: Targeting technology makes the advertising delivery crowd more accurate, and it is possible to advertise with thousands of people and thousands of faces. With the development of modern advertising industry, the technology of targeting users through user tags makes it possible for thousands of people to advertise, that is, the goal of advertising is not to put in the volume, but to put in the crowd, which correspondingly cancels the restriction of advertising volume.

Chart: Comparison of differences between leaderboard mode and buying mode

Source: Huawei Application Market, Application Bao, Tik Tok, Research Department of CICC.

Optimization of launching process: The emergence of real-time bidding system makes the launching process transparent and procedural. After the appearance of directional technology, the appearance of real-time bidding system makes it possible to bid for the effect advertisement in practice, which improves the transparency and proceduralization of the delivery process. From the actual situation, at present, the game purchase data of Tencent, Toutiao, Aauto Quicker and other channels are relatively transparent, and advertisers can clearly obtain the data about the purchase cost and effect.

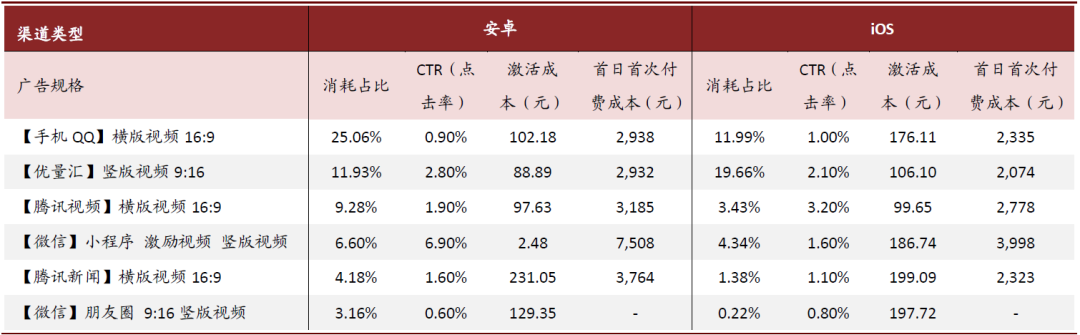

Chart: Zhou Du data of tencent games advertising at the end of 2020.

Source: Tencent Advertising, Research Department of CICC.

Note: 1) The statistical period is from December 28th, 2020 to January 3rd, 2021; 2)CTR: click rate. Advertising click rate = click volume/exposure *100%; 3) Activation cost: the advertiser pays for each activation cost = cost/activation amount; 4) First-day payment cost for a single user

= (Advertisements that accurately return the paid amount) the paid amount on the first day/(Advertisements that accurately return the paid amount) the advertising consumption on that day.

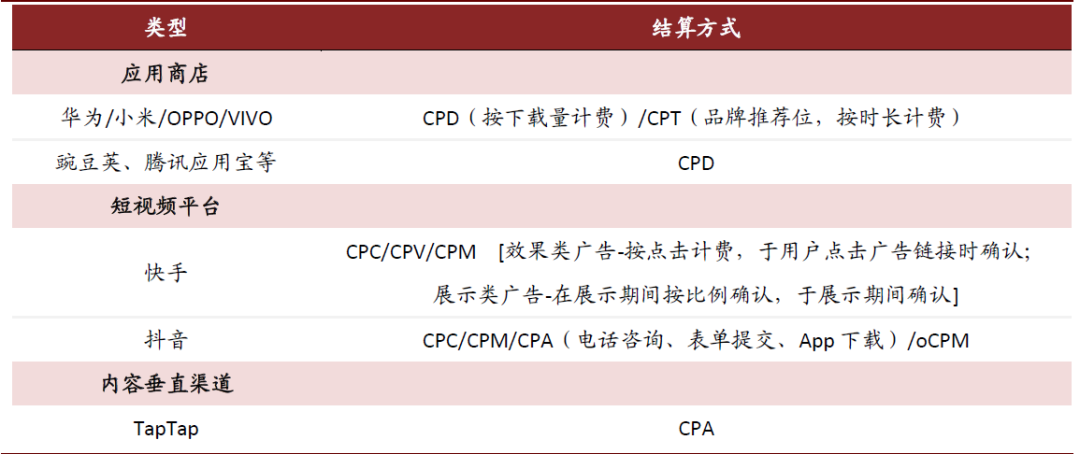

Optimization of settlement method: settlement according to CPA and other effects has become the mainstream, and the delivery effect can be measured. With the appearance of targeted advertising technology, it is possible to measure the effect, and the logic of advertisers’ realization of advertisements has also gone through the process from media realization (focusing on user scale) to user realization (effect advertising). Advertisers pay more attention to effective user value when measuring advertising efficiency, so it has become the mainstream to settle accounts according to the effect of advertising. At present, the mainstream short video platform and TapTap use CPA(Cost

Per action) for settlement, and some platforms adopt CPI(Cost per

Installation) and other ways for settlement. In order to meet the demand, in addition to the traditional intermodal sharing, application stores have also begun to provide advertising purchases. At present, CPD(Cost per) is generally adopted.

Download) for settlement.

Chart: Comparison table of settlement methods of different game distribution platforms

Source: company announcement, company official website, cucumber media, research department of CICC.

Profit optimization: continuous improvement of delivery efficiency. On the basis of the above three aspects, mainstream advertising platforms not only continuously improve the refinement and delivery accuracy of their own user tags through the accumulation of delivery data; It also provides advertisers with analytical tools for delivery efficiency, which helps to control the delivery rhythm, delivery cycle and delivery materials, thus improving delivery efficiency.

From the results, the effect of game buying is recognized. On the one hand, the number of game installations brought by unnatural traffic such as marketing has increased rapidly year-on-year; On the other hand, from the perspective of user retention, the retention rate of game users brought by unnatural methods (marketing) is even higher than that attracted by natural methods.

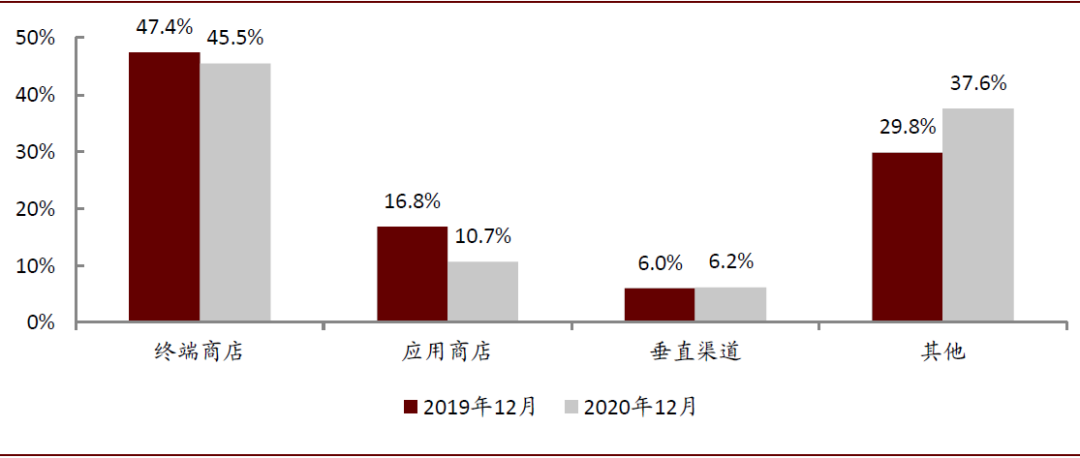

Chart: Distribution of App download channels in mobile game industry

Source: QuestMobile, Research Department of CICC.

Note: Terminal store refers to App.

The proportion of App aggregation in terminal stores such as Store, Huawei application channel, OPPO software store and vivo application store, the proportion of app aggregation in application stores such as App Store, 360 mobile assistant and Baidu mobile assistant, and the proportion of vertical channels only includes two channels: TapTap and 4399 game box.

#3 game quality trend: under the trend of long life cycle operation and quality development of games, the bargaining power of head R&D is improved.

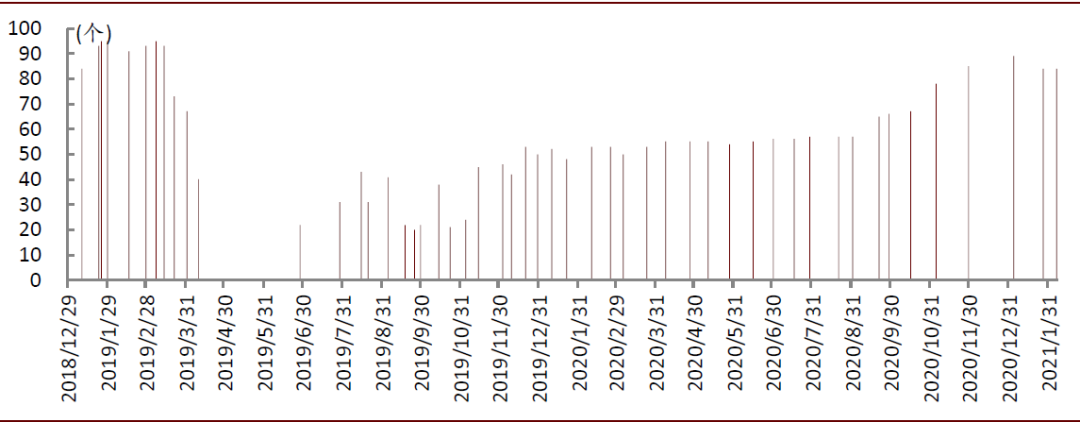

Under the restriction of policy and version number, the supply of market products decreases, and the long life cycle operation of fine products becomes an industry trend

Since the resumption of the approval of the version number on June 28, 2019, the rhythm of the approval of the version number has basically remained at the level of about 50-60 batches per month, and the number has been greatly reduced compared with that before the suspension of the approval of the version number. The reduction in the number of edition numbers has also led to a relative reduction in the supply of products in the game market. In the case that the version number is more precious and the product supply is reduced, the degree of game quality is also continuously improved. Therefore, it is a common choice for game manufacturers to operate high-quality games for a long time, so as to obtain long-term and stable running water income.

Chart: After the approval of version number is restarted, the supply of version number is obviously reduced.

Source: State Press and Publication Administration, Research Department of CICC.

Note: Statistics are as of February 19th, 2021.

On the product side, the level of game quality is improved, and high-quality products bring huge traffic.

Boutique games have their own traffic, and their dependence on the app store has decreased. With the improvement of players’ requirements for game quality and the stricter approval of version number, developers have also increased their investment in game research and development, which has jointly improved the quality of game products. And high-quality products, relying on excellent quality, have gained a lot of attention and appointments before going online.

Under the trend of long-term operation, the whole life cycle intermodal mode excessively erodes the profits of game manufacturers. As mentioned above, under the trend of decreasing the number of games on the supply side, the long-term operation of game products has become an industry trend. In the long-term operation scenario, the game relies more on brand and word-of-mouth to maintain and expand the player scale, without the short-term promotion resources provided by the application store; But you still need to pay 50% of the whole life cycle water share.

Game makers’ profit margins have been eroded. In contrast, under the game buying mode, the manufacturer only needs to pay the one-time effect advertising fee, and the later profit belongs to the game manufacturer completely.

Chart: the composition of game publishers’ expenses under the mode of channel sharing VS purchase volume.

Source: Research Department of CICC.

Note: 3%-5% channel fee, withholding tax, etc. are not considered on the basis of 50% share ratio.

Chart: under the Android channel, channel sharing and game revenue

Source: Research Department of CICC.

Note: Assuming that game users spend 100 yuan every month (excluding 3%-5% of channel fees, withholding taxes, etc.), the Android channel here is divided into approximate figures. Source: Research Department of CICC.

Chart: Game buying cost and income under buying mode.

Note: Assuming that the game users spend 100 yuan every month (excluding 3%-5% of channel fees, withholding taxes, etc.), the purchase cost here is an estimated value, not actual data.

Current situation of buying market: challenges and opportunities after national buying

Since 2020, the buying market has entered the era of universal buying, and game manufacturers have fully entered the buying market. On the one hand, it brings challenges such as the expansion of market scale, the entry of large manufacturers into the promotion threshold, and the increase in purchase volume and price; On the other hand, new opportunities have emerged. The long-term traffic operation of high-quality products and the marketing method of product-effect synergy have become the focus of game manufacturers.

Challenge: When big manufacturers enter the market, buying quantity becomes the standard of mobile game distribution, and market competition intensifies.

From the perspective of market scale, there is a nationwide buying boom in the game market, and Tencent Netease and other big manufacturers dominate.

Under the national buying craze, the number of materials and games in the game buying market increased rapidly, but the concentration of participants began to increase. Judging from the most direct indicator-game advertising material, according to DataEye data, from 2017 to 2019, the video material in the mobile game buying market grew at a rate of three times per year, basically achieving the national buying. Since the second half of 2020, the buying volume has entered a white-hot stage. Under the circumstances that strong demand drives fierce competition, although the total amount of game advertising materials has maintained a rapid growth trend, the number of companies has declined since 2H20, which reflects the improvement of the concentration of participants in the buying market.

Chart: The total number of materials put into game advertisements continues to increase.

Source: DataEye, Research Department of CICC.

Note: Statistics are as of October 31, 2020.

Chart: Trend of the number of game advertising companies

Source: DataEye, AppGrowing, 2018 China Game Industry Annual Meeting, Pangolin Launch Platform Announcement, Company Announcement, Company official website, Research Department of CICC.

Note: Statistics are as of October 31, 2020.

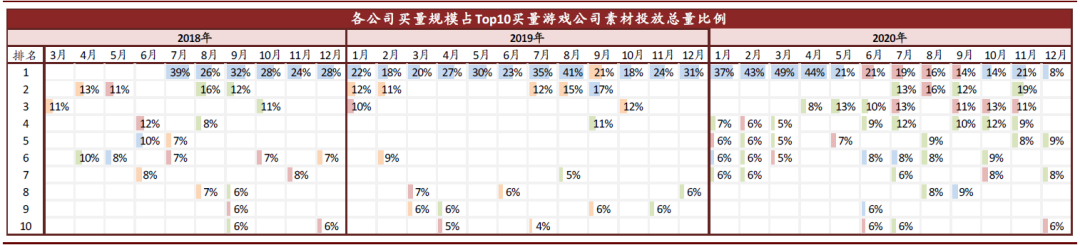

Tencent Netease and other big companies entered the market and occupied the main share of the buying market. We counted the game companies that launched top10 in the past few years, and found that Tencent, Netease, Sanqi and other big companies gradually occupied the forefront of the launch list. The entry of high-quality products into the buying market objectively improves the intensity of competition. At the same time, the proportion of advertising for head products is gradually increasing.

Chart: Tencent, Netease and other big manufacturers have increased their participation in buying, and gradually occupied the Top10 of the game advertising materials.

Source: DataEye, Research Department of CICC.

Note: Blue is Tencent (Shenzhen Tencent Computer System Co., Ltd. and Tencent Technology (Shenzhen) Co., Ltd.), pink is Netease (Guangzhou Netease Computer System Co., Ltd. and Hangzhou Netease Leihuo Technology Co., Ltd.), orange is Sanqi Entertainment (Shanghai Hard Link Network Technology Co., Ltd. and Anhui Shangqu Play Network Technology Co., Ltd.), and green is Perfect World, Lilith, Youzu Network, ByteDance, Ali Games, Kaiying Network, Zi Long Games, Ali Games.

In the dimension of competition, the prices of materials and purchases have risen in an all-round way, and the competition tends to be fierce.

With the increase of market participants, the price of traffic continues to rise. We judge that in the past few years, the traffic price has been rising slowly. Looking forward to the future, considering that buying quantity is becoming more and more an important means to acquire users, we expect that the price of buying quantity will continue to grow steadily.

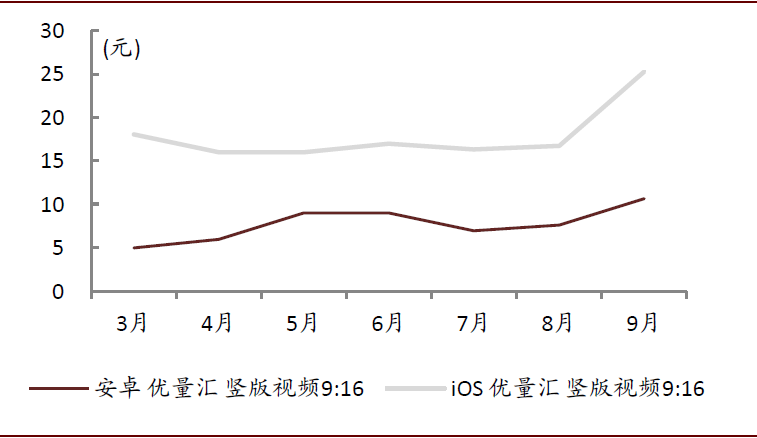

Chart: Tencent Youlianghui Vertical Video 9:16 Android and iOS Single User Activation Cost (March-September 2020)

Source: Tencent Advertising Monthly, Research Department of CICC.

Note: Activation cost: cost paid by advertisers for each activation = cost/activation amount.

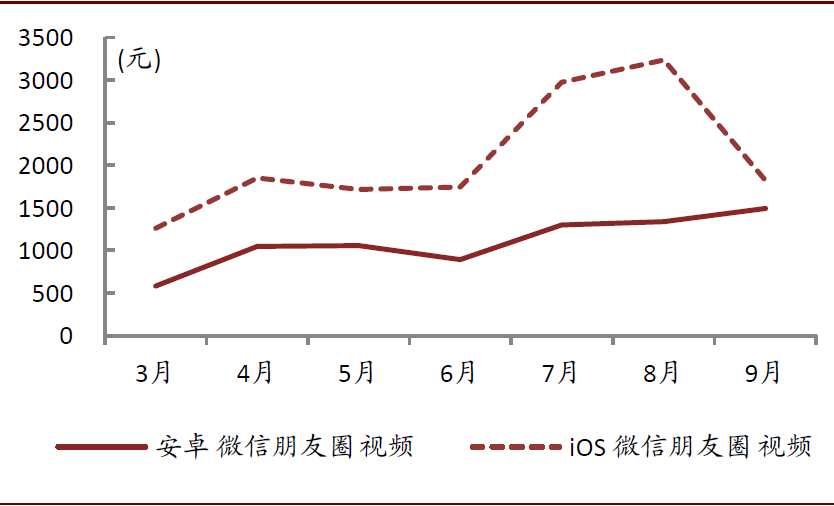

Chart: The first-day first-time payment cost of a single user of WeChat friends circle video Android and iOS (March-September 2020)

Source: Tencent Advertising Monthly, Research Department of CICC.

Note: the first-day payment cost of a single user = (the advertisement with accurate payment amount) the first-day payment amount/(the advertisement with accurate payment amount) the advertising consumption of the day, which is used to optimize the advertising position.

In the fierce competition environment, the cost of materials is also rising. On the one hand, under the circumstance that all parties increase the delivery, the attraction of homogeneous and poor quality logistics materials to users is declining, forcing publishers to improve the quality of materials; On the other hand, because the purchase price is getting more and more expensive, in order to obtain the highest efficiency, the material needs higher quality to attract users better, thus improving the ROI.

In terms of product distribution, the purchase volume has brought about the decentralization of the game market and the clearing of the tail game.

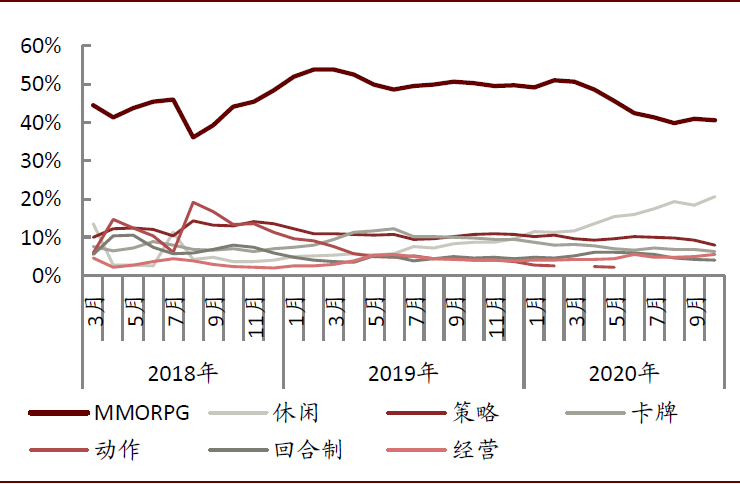

Among different categories, the development of buying volume has brought about the decentralization of game categories. Buying quantity can make products reach the target users of specific categories more quickly and directly, instead of the high-flow categories in the application store leaderboard mode in the past, so the subdivided categories have gained more room for development. It should be pointed out that the change of the proportion of specific game categories is not only influenced by the factors of buying quantity, but also by the online cycle of specific products. However, we judge that the overall trend of buying quantity has a certain impact on category diversification.

Chart: MMORPG always occupies the forefront of the advertising list in terms of buying volume.

Source: DataEye, Research Department of CICC.

Note: The proportion shown in the figure is the proportion of games with advertisements in this category.

Chart: However, in terms of revenue ratio, among the top 100 mobile game revenue products in China, the proportion of role-playing is declining.

Source: Game Committee, Gamma Data, Research Department of CICC.

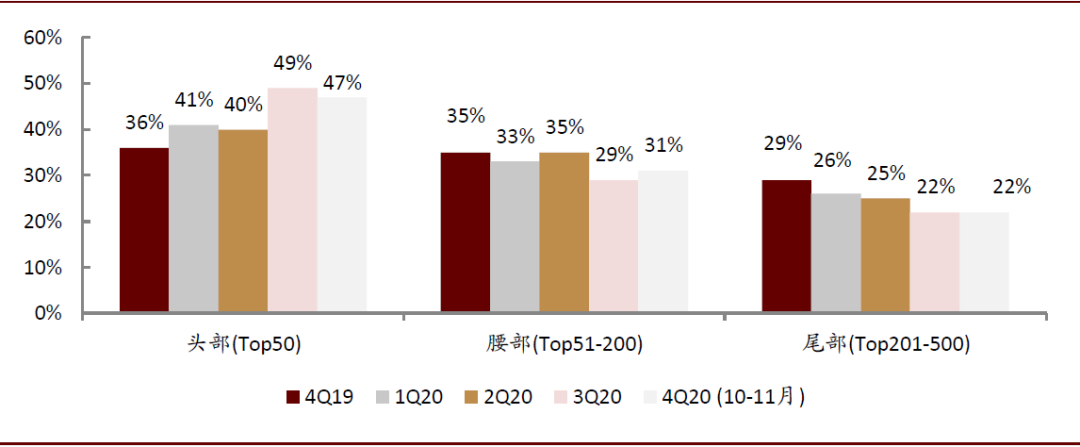

The proportion of head games has increased, and the tail games have been accelerated. According to the statistics of hot cloud data, the proportion of game purchases in the creative group Top201-500 decreased from 29% in 4Q19 to 22% in 4Q20. We judge that with the more intense competition in buying volume and the rising cost of buying volume, the tail game will accelerate its clearing.

Chart: game buying quantity, number of creative groups, Top500 and proportion distribution chart

Source: Thermal Cloud Data, Research Department of CICC.

Opportunity: the weight of high-quality content is improved, and refined traffic operation improves efficiency.

The ability to buy is divided into CAC and LTV, and effective traffic operation can achieve LTV>CAC.

Boutique content can get users through lower CAC(Customer acquisition cost) without the application store channel, resulting in larger LTV(Life).

Time value, life cycle value). Since 2019, we have found that many products have not chosen the Android channel.

Chart: Typical game products that have not been selected or postponed to the Android App Store channel (incomplete statistics)

Source: TapTap, Bilibili, Easy to Travel and Quick to Explode, App Bao, 360 Mobile Assistant, Jiuyou, Xiaomi App Store, Huawei App Market, Game official website, and Research Department of CICC.

Note: 1) As of October 20, 2020, there were 130 exclusive games on TAPTAP (take the App labeled "TapTap Exclusive" on TapTap); 2) The channel here only counts Android; 3) The place marked in red is the download channel displayed by official website; 4) "√" means to confirm that the channel has been launched or has been launched, and "reservation" means that the channel has not been officially launched yet (part of it is confirmed to be on the shelves, but the time has not yet come).

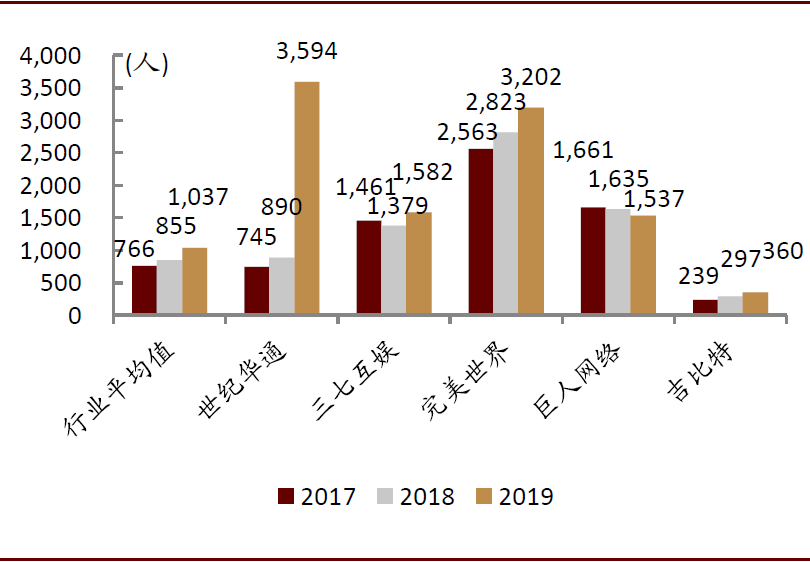

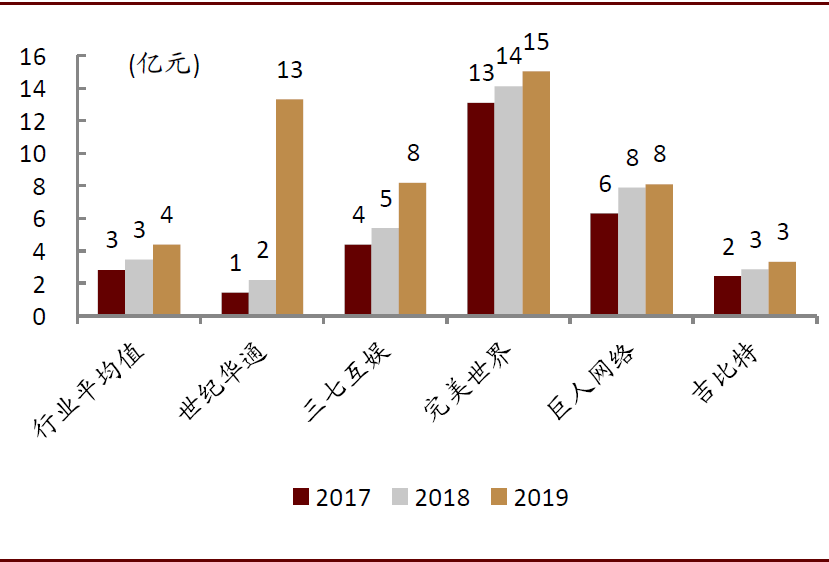

Under the objective trend of fierce competition in buying quantity, the quality of products has become the ultimate factor to determine the effect of buying quantity. High-quality products are more likely to enlarge their competitive advantage by buying quantity, while products with average quality can gain users by buying quantity in the early stage, but they will be quickly lost, and even the old products will drop rapidly after the same batch of users continue to "wash" new products. Therefore, manufacturers continue to increase R&D personnel and capital investment, and enhance their competitiveness through quality content supplemented by purchase.

Chart: The number of R&D personnel of most head listed companies continues to grow.

Source: Company Announcement, Research Department of CICC.

Note: 1) The sample is taken from Top5 Company with the market value of CITIC (Game) as of November 6, 2020; 2) The R&D personnel in century huatong increased significantly due to the acquisition of Shengqu Games in 2019.

Chart: R&D expenditure of head listed companies continues to grow.

Source: Company Announcement, Research Department of CICC.

Note: 1) The sample is taken from Top5 Company with the market value of CITIC (Game) as of November 6, 2020; 2) century huatong’s R&D expenditure increased significantly due to the acquisition of Shengqu Games in 2019.

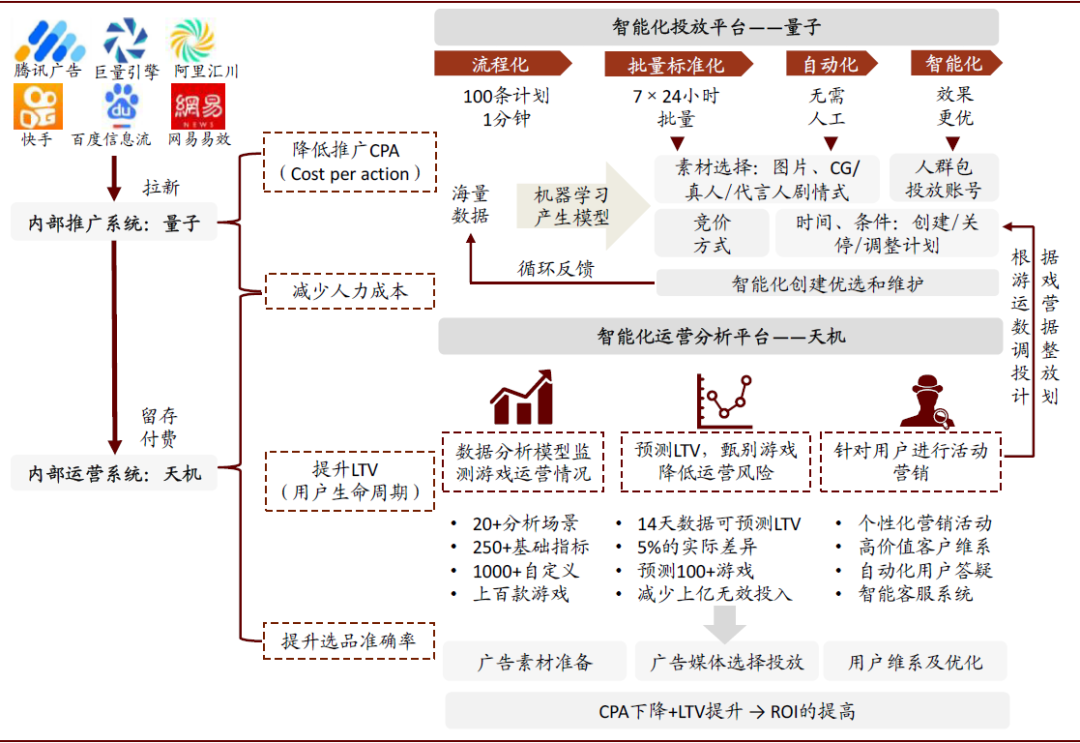

The core of buying quantity is to better match CAC<V in the scene of larger traffic, and the difference of buying quantity efficiency reflects the difference of putting capacity. Since 2019, thanks to the continuous improvement and optimization of the advertising platform, the threshold for advertising purchases has continued to decrease. Generally, as long as the distributor accesses the API of the platform, it can upload the delivery materials, select the target population according to the labels, control the delivery time and frequency, and monitor the effect. Therefore, the difficulty of buying quantity in operation is reduced. However, the differences in the learning process and delivery technology of tag precipitation for the target group bring about the differences in delivery efficiency, that is, the differences in CAC; The long-term operation ability of products reflects the difference of LTV.

Chart: traffic operation model: Sanqi Entertainment improves the efficiency of buying and selling through the "quantum" and "secret" systems.

Source: Company Announcement, Research Department of CICC.

A new growth engine: the marketing idea of product-effect synergy brings the accumulation of brand value.

The marketing idea of product-effect synergy brings the accumulation of brand value. Under the trend of increasing the cost of buying, the market’s concern about the long-term effect of buying is also expanding. In the face of fierce market competition, we have noticed that the current purpose of buying games has stopped at the promotion of a single product, and more attention has been paid to the long-term branding of manufacturers. On the one hand, there are more and more manufacturers’ brand logo in the game buying advertisements; On the other hand, the online buying cycle of publishers is lengthened, and offline promotion activities and brand advertisements are also adopted to enhance the long-term influence of brands. For example, recently, we noticed that we are addicted to games, Lilith began to put brand advertisements in elevator media, and Tencent’s "Under the Great Picture" put advertisements in cinema video media in November.

Chart: The original "Blue Moon" game material-no company brand logo

Source: Company website, Research Department of CICC.

Chart: the new version of the naughty game company logo is exposed.

Source: Company website, Research Department of CICC.

The influence of the rise of buying volume on the development trend of game industry: content is king, and channel reform advances in twists and turns

Domestic: content is king, long-term channels may make profits, and the profit margin of game manufacturers integrating research and transportation is expected to increase.

We judge that the change of game distribution channels will continue to have a far-reaching impact on the industrial chain: on the one hand, the advantages of integrating R&D with research and transportation will be extended to the bargaining power facing the channels, which will help improve the profit margin of game manufacturers; In addition, R&D companies began to consciously guide R&D with purchase quantity distribution in R&D, which is helpful to improve the effect of product purchase quantity. On the other hand, the proportion of distribution channels is expected to gradually decline in the long run, and we expect that the vertical channel of content represented by TapTap is expected to develop rapidly.

On the side of game developers, the advantages of integration of research, development and transportation are extended to the bargaining power of channels, and the profit rate is expected to increase.

The quality of R&D is further improved, and the bargaining power of game manufacturers is enhanced, which is expected to help improve the profit margin. As mentioned above, the development of the buying market, the guidance of the policy side and the improvement of players’ requirements have all led to the continuous improvement of the quality of game research and development. We judge that in the future, with the further deepening of the national purchase, high-quality products will gain more market share. Under this trend, the market share of manufacturers integrating R&D and transportation is expected to increase, and the bargaining power in the face of channels will continue to increase. If game manufacturers get a more favorable share ratio in the future, it will help to improve the profit margin of game manufacturers.

The importance of long-term operation of boutique games continues to increase. On the operation side, the long-term operation of boutique games will be more important. Whether it is through the reduction of purchase volume or channel sharing, it has become an important goal of game companies to obtain as many LTV as possible through long-term operation. In terms of operation mode, version updating, buying quantity and brand advertising will be comprehensively used.

On the channel side, in the long run, it is the general trend to reduce the proportion of Android channels, and the long-tailed players in the buying market continue to clear out.

Android channel: game makers and Android channels need each other, and the long-term share is proportional or declining.

Game makers can’t completely give up the Android channel, but its importance has declined. Considering that the Android channel, especially the hardcore alliance, still has a considerable user scale, we judge that the Android channel will remain one of the important channels for game distribution in the future. However, from the trend point of view, its MAU growth rate may continue to decline, and the scale of users of third-party application channels may decline rapidly.

The Android App Store can’t completely reject games, and game products play a pillar role in the revenue of the App Store. According to App

Annie, the top100 games in the world account for 65% of the total mobile game revenue. If more and more head game products can’t choose the Android channel, the Android app store may face the crisis of shrinking revenue, which will force the channel reform. We have observed that at present, some small channels in the industry have actively chosen to provide the official Android package for users to download because they can’t get the head game, giving up the water sharing to maintain the channel brand and users.

In the future, the proportion of Android channels will gradually decline, and it will become a platform for products to reach long-tail users. Due to the realistic pressure, the Android channel may gradually reduce the current share ratio of more than 50%, but this process will be longer. In addition, we noticed that products such as "The Strongest Snail" and Genshin Impact did not choose the Android channel in the early stage, and they chose the Android channel to be put on the shelves a few months after they went online. We believe that this practice of "official website first+buying quantity, then Android channel" can fully tap the value of core word-of-mouth users and play the role of buying quantity in the early stage of product launch, while avoiding Android channel sharing; On the other hand, if the Android channel is launched a few months later, you can use the accumulated popularity of the product to reach the potential long-tail users of the Android channel.

Buying volume market: players continue to clear out, and high-quality products with refined traffic operation become the key. In the case that the national purchase has become a reality, the competition in the future purchase market will continue to be fierce, and the number of participating companies will decrease, but the purchase scale will continue to expand. The competition of buying quantity will fall more on the cooperation of high-quality products and efficient buying quantity, and the refined traffic operation of boutique games will get better results.

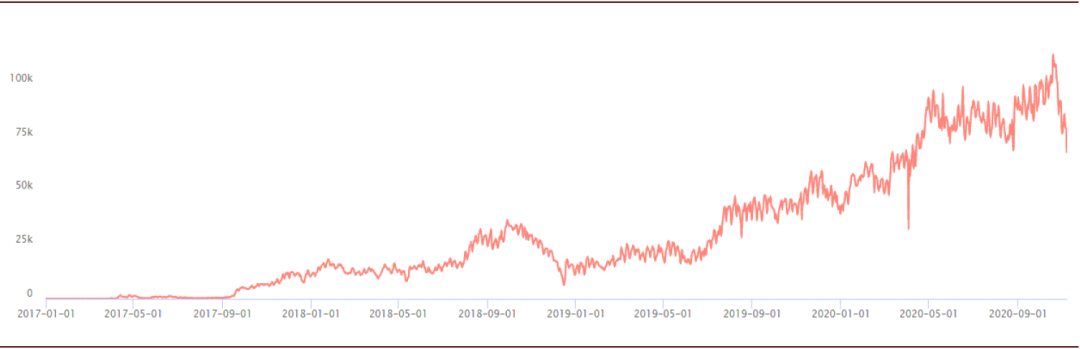

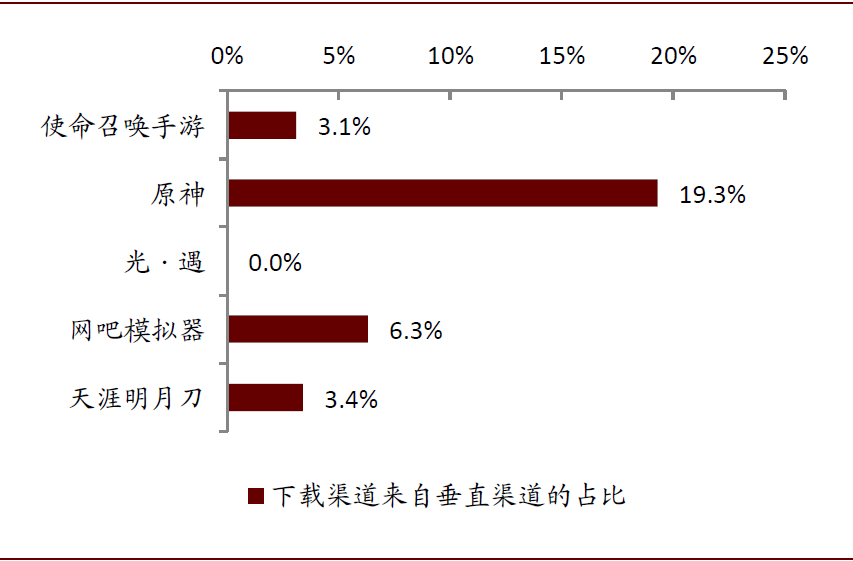

Emerging channels: Vertical channels with strong community atmosphere, such as TapTap, will be favored by more manufacturers. We believe that from the business model, TapTap may represent a possible model of future game distribution channels, that is, it does not participate in running water sharing, but only realizes it by advertising, forming a community platform where gamers gather. At present, TapTap is committed to building a bridge between game developers and gamers, and only realizes it in the form of advertisements without participating in the water sharing.

Chart: TapTap advertising space and the data of internal test in 2017.

Source: TapTap, Research Department of CICC.

Note: The average number of single show = the total number of shows/games during the internal test; Average number of downloads for a single item = total number of downloads/number of games during internal testing.

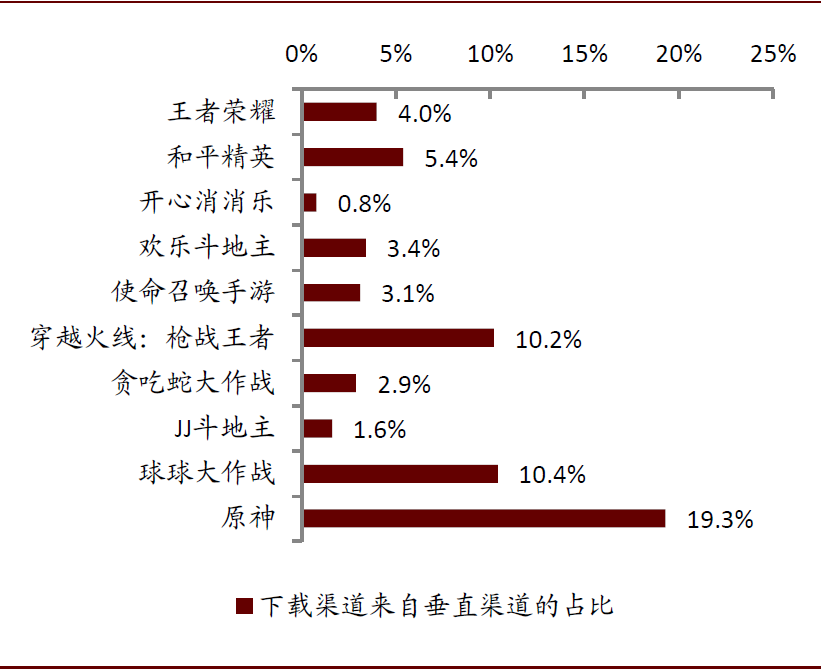

Chart: In the download channels of mobile game product Top10 in 2020, the proportion from vertical channels, such as TapTap, etc.

Source: QuestMobile, Research Department of CICC.

Note: 1) The vertical channel only includes the aggregate proportion of TapTap and 4399 game box; 2) Top10 mobile game products are sorted according to MAU of APP in December App2020.

Scenario Hypothesis: Influencing Factors and Process of the Decline of Domestic Android Channel Streaming Share

Influencing factors of running water sharing negotiation: the balance between relative strength and interests of both sides

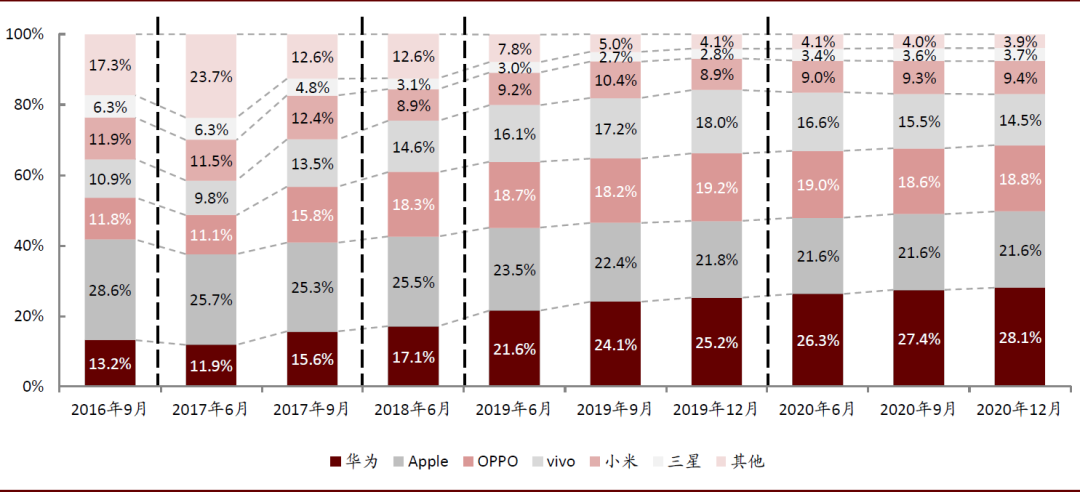

Relative strength: the market share of mobile phone hardware manufacturers basically determines the bargaining power of channels, and high-quality products determine the bargaining power of game manufacturers. At present, the influence of third-party game distribution channels is gradually declining. We believe that the core of channel division lies in the toughness of hardware manufacturers (official mobile app stores) represented by hard-core alliances. The root of the official app store’s discourse power lies in the market share of mobile phones. Therefore, if there is an increase in the market share of a certain mobile phone brand, it will master more users, and the increase in relative strength will make the channel tougher; On the contrary, the decline in the market share of mobile phone brands will relatively weaken the bargaining power of channels. In the recent incident between tencent games and Huawei, Huawei’s tough removal reflects the process that Huawei’s bargaining power has increased after its mobile phone market share has increased. From the perspective of game manufacturers, in the past, we have seen that some head products have achieved an ideal share ratio in negotiations with channels, or they have the ability to abandon Android channels in the event of unsuccessful negotiations.

Chart: Changes in the proportion of active devices of various brands of smart terminals in China.

Source: QuestMobile, Research Department of CICC.

Note: Glory brand is counted as Huawei brand in statistics.

Chart: The app store still relies mainly on game applications to generate revenue, and the game revenue accounts for more than 65% of the total revenue of the app store.

Source: SensorTower, Research Department of CICC.

Degree of cooperation: the degree of cooperation of Android channels, especially the attitude of hardcore alliance. As discussed earlier, the hardcore alliance is the maker of the 50% sharing rule of Android channel, and it occupies the vast majority of the Android mobile phone market. Therefore, whether the hardcore alliance is consistent in the future and adheres to the 50% sharing will become the key. At present, it can be seen that some manufacturers have made concessions to some head products.

Substitute products: the substitution effect of buying volume market on channels. The other side of the rise of the buying market is the weakening of the strength of the Android channel. Therefore, if the size of the buying market continues to expand in the future and the needs of game manufacturers to obtain users by buying quantity are further met, it will continue to force the reform of the Android channel.

Case study: the comparison between Xiaomi’s game distribution income and mobile game market income, and the formation of scissors difference in income growth.

We compare the growth rate of Xiaomi game revenue and mobile game market revenue to illustrate the changing process of the strength comparison between channels and game manufacturers. Due to the suspension of the approval of the game version number in 2018, the growth rate of mobile games slowed down, and the revenue of Xiaomi games also showed negative growth in 4Q18. During this period, the relative strength of Android channels and manufacturers did not change significantly. In 2019, the mobile game market gradually recovered after the approval of the version number was restarted. During this period, the buying market began to rise, but the whole people did not buy it. Therefore, after the new 2H19 product was gradually launched, Xiaomi’s game revenue increased rapidly, which was higher than that of the mobile game industry. During this period, the influence of buying volume and game quality on the channel was not obvious. After entering 2020, the fiery game market during the 1Q20 epidemic will drive Xiaomi’s game revenue to increase greatly; However, since 2Q20, the growth rate of Xiaomi’s game revenue has declined, and the mobile game market revenue has continued to grow; By 3Q20, due to the hot buying market, the income growth rate of both parties showed a scissors difference. Under the background of the continuous growth of the mobile game market, Xiaomi’s game income was negatively increased, which reflected the influence of the national buying volume and the strength improvement of game manufacturers.

Chart: Comparison between the growth rate of Xiaomi game revenue and the growth rate of mobile game market revenue.

Source: Game Working Committee of Audio-Digital Association, Company Announcement, Research Department of CICC.

Note: Xiaomi did not disclose quarterly income before 2017, so there is no quarterly income growth data in 2017. Xiaomi game revenue refers to game distribution revenue.

Chart: Excluding the influence of the change of mobile phone market share, the relative proportion of Xiaomi’s game revenue decreased from 2Q20.

Source: Game Working Committee of Audio-Digital Association, Gartner, Company Announcement, Research Department of CICC.

Note: Xiaomi game revenue refers to game distribution revenue. Xiaomi mobile phone market share * The scale of mobile game market reflects the total revenue of the game market from Xiaomi mobile phone. The Xiaomi game revenue/(Xiaomi mobile phone market share * mobile game market scale) reflects the influence of excluding the change of Xiaomi mobile phone market share, and relatively shows the change of the relative revenue share of Xiaomi games.

On February 3rd, 2020, Genshin Impact updated version 1.3 four months after its official release, and launched Xiaomi App Store for the first time, while the share of Genshin Impact and Xiaomi was 7:3. In addition, Xiaomi has provided Genshin Impact with promotional resources, including store opening advertisements, first-screen big pictures, browser advertisement recommendation places, etc. On the first day, Genshin Impact downloaded more than 680,000 times in Xiaomi App Store. We believe that Xiaomi App Store’s concession to the proportion of head games such as Genshin Impact but not the first game shows that the bargaining power of head games continues to increase, and Android channels are highly dependent on head games; In the long run, under the pressure of head game manufacturers and their own performance, the proportion of Android channel app stores is declining.

Chart: Genshin Impact downloaded more than 680,000 times on the first day of Xiaomi App Store.

Source: Liftoff, Research Department of CICC.

Note: download data as of February 3, 2021.

Chart: The proportion of download channels of new online mobile game product Top5 from vertical channels in the past year.

Source: QuestMobile, Research Department of CICC.

Note: 1) The vertical channel only includes the aggregate proportion of TapTap and 4399 game box; 2) In the past year, the online mobile game product Top5 was ranked according to the MAU of APP in December App2020.

Scenario Hypothesis: Decline Process and Sensitivity Measurement of Android Channel Streaming Division

We believe that the decline of Android channel water sharing needs to go through a process. Judging from the current situation, it is basically a single product and channel negotiation one by one, and it is still in a relatively early stage as a whole. Taken together, we expect that this process may be divided into the following four steps:

In the first stage, small and medium-sized channels made concessions to head developers, and the proportion of head products in small and medium-sized channels was reduced. At present, some practices have been seen. At this stage, some games began to abandon the Android channel and rely entirely on buying.

In the second stage, the proportion of key products of head developers in the head Android channel decreased, and the proportion of all products of head manufacturers and key products of small and medium-sized manufacturers in the small and medium-sized channels decreased. At this stage, some games got concessions from the head channel. For example, Genshin Impact recently made a breakthrough in Xiaomi App Store, but the process was repeated and different games were different.

In the third stage, the key products of head manufacturers made a breakthrough in an all-round way. At this stage, the products of head manufacturers and key products of medium manufacturers may get a higher share; However, the non-key products of medium-sized manufacturers and small manufacturers will basically maintain their original share. In addition, there may be a step-by-step sharing mode during this period, that is, the proportion of channel sharing is high in the initial stage of product launch, but it gradually decreases in the later stage.

Finally, the proportion of the whole industry is reduced to become the standard. In this process, we expect that in the initial stage, individual manufacturers need to negotiate with different channels on individual products one by one, but in the end, a lower share ratio will become the industry practice.

Chart: Android channel is divided into proportional change stages.

Source: Research Department of CICC.

Measurement of income sensitivity of R&D and transportation integrated manufacturers after channel sharing changes. We take the distributable total flow of 100 yuan (after deducting channel fees, withholding taxes and fees, etc.) as an example to illustrate the influence of the change of channel sharing on the income of game manufacturers. Under the current situation that the Android channel is divided into 50%, game manufacturers can get 50 yuan income before deducting the purchase cost, but if the purchase cost is considered, the income will be lower. We calculate the revenue of game makers after deducting channel share and purchase cost when the proportion of channel share and purchase cost changes. In a neutral situation, if the share of Android channels is reduced to 30% and the purchase cost is 20%, the R&D and transportation integrated manufacturer can still get the income of 50 yuan. In addition, we believe that after the proportion of channel sharing decreases, game makers can bear a higher level of purchase expenses while getting a higher share, thus gaining more users and further improving the flowing ceiling.

Chart: Revenue calculation of game manufacturers under different proportions of Android channels (assuming that the total distributable water is 100 yuan after deducting channel fees, taxes, etc.)

Source: Research Department of CICC.

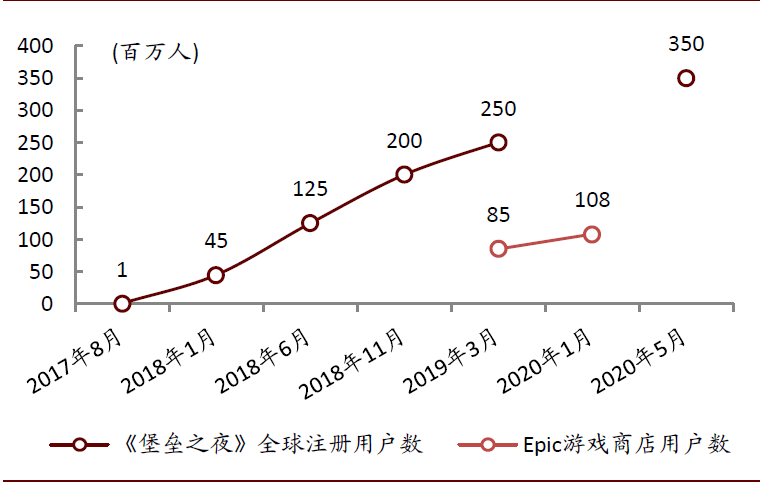

Note: The proportion of this punishment is the proportion of game combined transport after deducting channel fees, withholding taxes and fees; The income after deducting channel share and purchase cost by game makers reflects the influence of the change of channel share and purchase cost ratio.

Overseas: The debate between channels and R&D companies is far from over, and the content is that the trend continues.

On the issue of market share, we have counted the share of major game distribution channels in the world, and found that the share of overseas game channels is basically below 30%. At the same time, at present, channels and developers are still fighting each other, and Epic is still fighting with Apple to reduce the commission rate by 30%. We judge that the global debate between channels and R&D providers on sharing is far from over.

Chart: Share/commission ratio of major game distribution channels in the world

Source: TapTap, Bilibili, Easy to swim and quick to explode, App Bao, 360 Mobile Assistant, Jiuyou, Xiaomi App Store, Huawei App Market, Game official website, ANALYSIS.

GROUP, research department of CICC

Note: 1) There are different proportions of channel fees, channel fees and withholding taxes in some stores on the Android side (for example, the channel fees of Huawei’s application market are 3%), and this proportion is divided based on the income after deducting the above fees; 2) The commission rate with "*" as the third party source is not directly disclosed by the market; 3) The above data is as of December 2020.

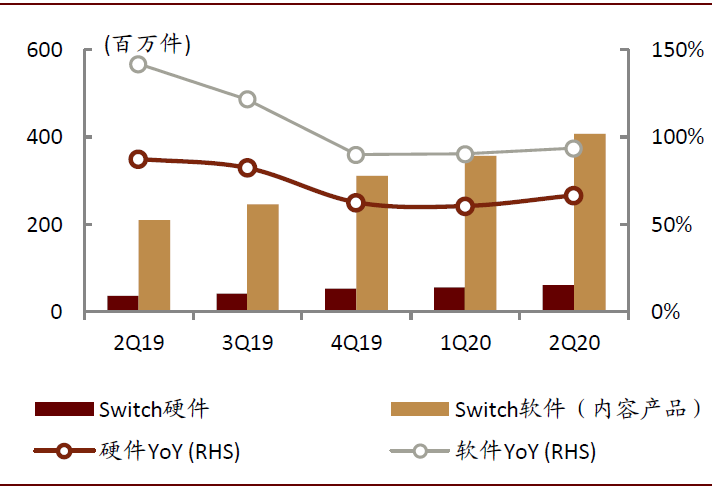

From the trend of overseas markets, the content is that Wanghui will continue, and we are optimistic about the pulling effect of content on the platform. High-quality content can not only bring rich benefits to developers, but also be an important escort cornerstone of the distribution platform. For example, Night of the Fortress has driven the user scale of Epic App Store, and high-quality console games such as Animal Friends Club have driven the sales of Switch. We believe that the trend that content is king is expected to continue, and the pulling effect of high-quality content on the platform will be more significant.

Chart: fortress night and the evolution of Epic game store user scale

Source: Epic Games, GamesBeat, Statista, research department of CICC.

Chart: High-quality products such as Animal Forest Friends Association drive Switch sales.

Source: Company Announcement, Research Department of CICC.

(Editor: Yujing)