Innovation is the driving force of urban development. Kaiwu Innovation Building, located in the west of Hangzhou, is a Class A office building with innovative temperament. It was developed by Xihu Investment, a veteran state-owned enterprise in Xihu District, Hangzhou, and Hangzhou Vanke. It took four years to design and build, and finally completed this "new landmark" like mortise and tenon.

Let’s talk specifically, where is it "new"?

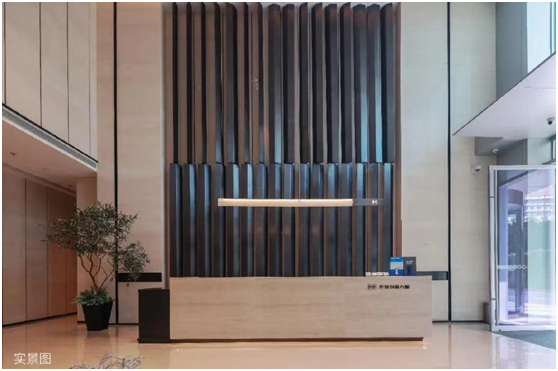

Real-life map of Kaiwu Innovation Building

Part01.

Like a building block, break the conventional shape.

This is a building that pays attention to the integration of meaning and form.

On the one hand, its appearance is highly recognizable, and it is not a common "glass box" style. From a distance, it looks like a patchwork of building blocks, and it looks like a mortise and tenon of a traditional building. Through the mutual engagement of parts, it forms a solid whole. The name "Kaiwu" comes from the first encyclopedia in ancient China, Tiangong Kaiwu, hoping to borrow old things to tell new things and "connect" cities, regions and people with one building.

Although it is not the "highest, largest and most expensive" emphasized by general landmarks, it is impressive with its unique and lively urban expression.

Tenon-mortise principle

Architectural concept map

The real-life map of Kaiwu Innovation Building looks like a traditional mortise and tenon in China.

On the other hand, behind the appearance is an insight into the "office trend" and a reflection on "efficiency and humanity". The scattered space forms can meet the needs of enterprises of different scales and stages, increase the line of sight between indoor space and outdoor environment, and create an open space with a sense of leisure. This can not only make employees full of energy at work, but also feel the fun of city life after work.

Ancient wisdom and modern life have completed a new exchange.

Strong visual tension is formed through the deconstruction and reorganization of the volume.

Night view of the building.

The details of the facade are real, and the light gray metal is quite textured.

Part02.

Like a plug-in, integrate into the operation of the city.

This is a building that "merges into the city".

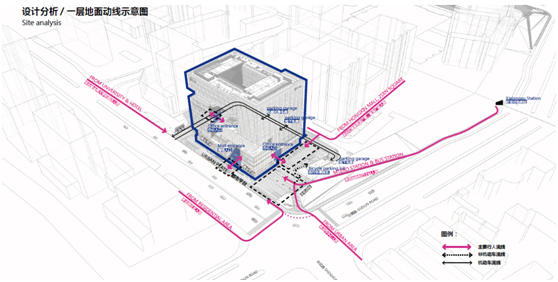

If the city is regarded as an operating system, the information can be transmitted quickly through the connection of traffic. The building is adjacent to the exit of Xialongwei Station of Metro Line 2, about 500 meters away from Sanba Station. Shi Xiang Road connects Liushi Expressway to run through the east and west of Hangzhou, and Zijingang Road connects Zizhi Tunnel to the south to reach Binjiang and Zhijiang Zhuantang. In addition, the building overlooks the Zijin Campus of Zhejiang University, is opposite to the Cambridge Commune, and is about 800 meters away from the Grand Canal Park. Its walking environment is relatively mature.

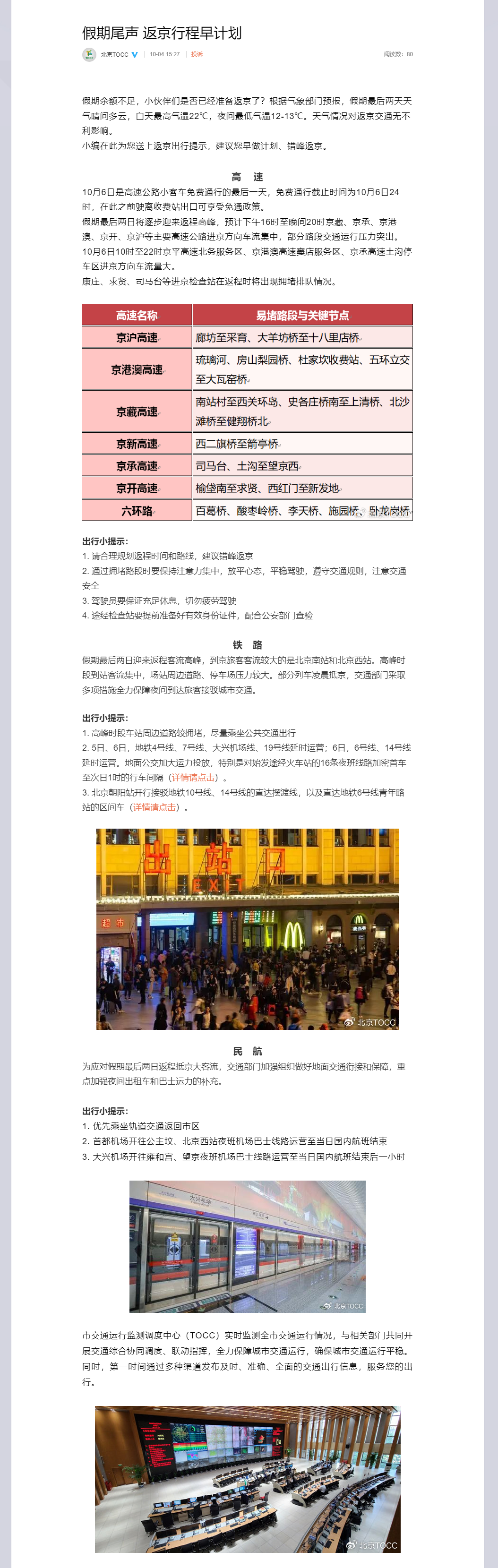

Location analysis map, for reference only.

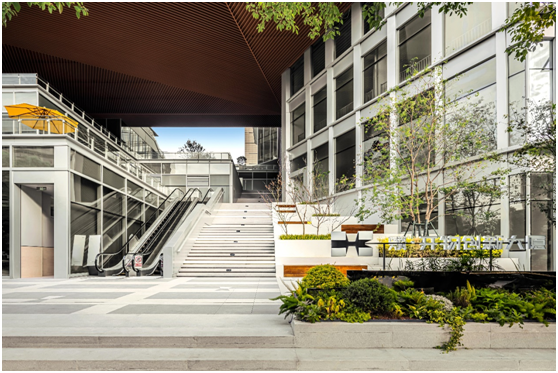

The building is open to the city, and entrances and exits are set in different directions. The vacant east square can accept the people flow from the nearby subway station and commercial center, and there is a basement entrance and bicycle parking space conspicuously. Although the south boundary is close to the main road of Shenhua Road, it broadens the site scale and strengthens the interaction between the building and the city through the "concave" urban stairs and platforms. In addition, for municipal reasons, a three-dimensional social parking lot has been built within the plot to make parking more convenient and free.

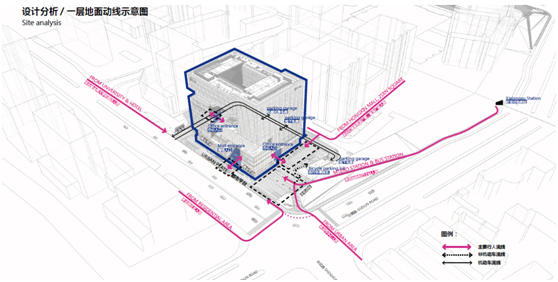

The streamline analysis diagram of Kaiwu Innovation Building is for reference only.

The floor plan of Kaiwu Innovation Building is for reference only. For municipal reasons, a three-dimensional parking lot has been built within the plot to make parking more convenient and free.

Part03.

Like a park, it provides moderate openness.

Another highlight is that it provides an open space for daily life in series.

At present, in addition to salary, employees pay more and more attention to the soft benefits provided by office space, so social attributes and flexibility are the key to future office work. The future office is no longer a fixed station, but a place that should stimulate team creativity and strengthen team cooperation, and it is also a community where employees socialize daily.

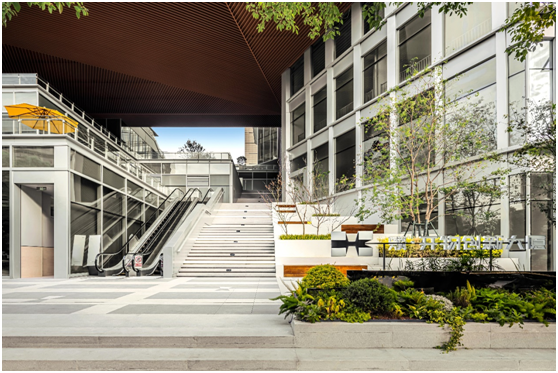

A real view of the atrium, looking from the north side to the south side.

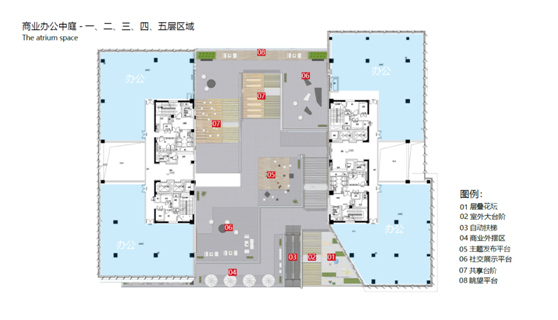

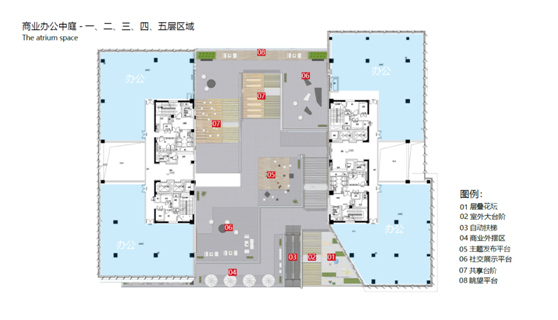

Atrium plane area (looking down from the fifth floor office)

Different from the compact and serious planning of general office buildings with less green space, Kaiwu Innovation Building hollows out a large area of gray space, and comprehensively creates multiple office spaces such as shared large steps, terraces, balconies, accessible roofs and landscape office boxes. 1-4F of the building is an external vitality sharing floor, which extends from work to coffee, retail, social interaction, leisure and other formats, thus bringing "full-scene office" service to the settled enterprises and forming a harmonious atmosphere with the surrounding campus and residential areas.

The real-life map of open space provides more possibilities: office is no longer limited to indoor and office function itself.

AaaM, the construction team, has planted multi-level greening and leisure space in the previous loft49 office project. This time, the sharing step draws on The Commons, the commercial benchmark of Thai communities, to create a pleasant and amiable office community atmosphere.

Through the 1-4F layer-by-layer concession, the building creates an upward momentum, arouses people’s enthusiasm for actively approaching the building, and also forms an organic effect of gradual infiltration of urban landscape. The building uses steps and platforms to expand the area of outdoor space and carry rich daily functions such as transportation, sightseeing, rest and temporary office.

This design technique also enhances the externality of "non-first-floor business", and can also increase the appeal of its catering by swinging outward. Because the platform is large enough and covered by the roof, it will not affect the use even in midsummer or rainy season, and provide support for enterprises to hold various exhibitions and activities.

The gray space here is creating an atmosphere of "communion". Plants everywhere bring a natural atmosphere, and chairs with various postures provide a rich sense of body. White-collar workers can wander on the steps at noon or after work to relax their body and mind; Visitors can buy a cup of coffee, lean over the road and feel the sunshine kiss; Students and residents nearby can also participate in activities in the park freely, watch exhibitions, lectures and performances, and enjoy the benefits brought by urban development.

Sharing big steps and infiltrating greening

2F Real-life map of shared platform

4F Real-life map of shared platform

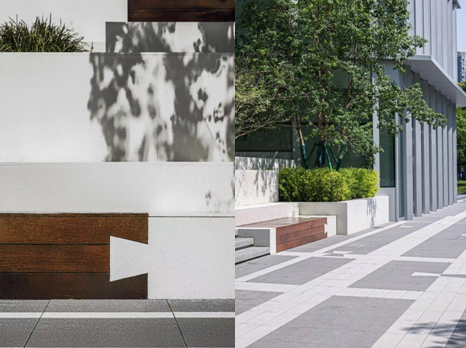

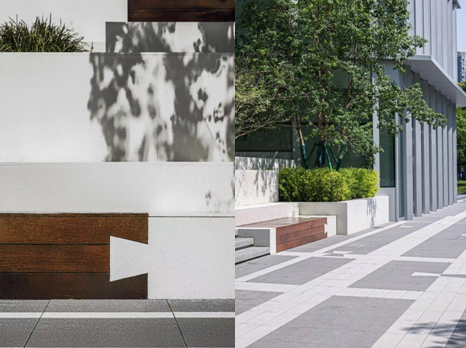

In low-rise buildings, the facade of shops, the floor of platforms, and even furniture sketches are mostly in light and dark pixel plaid language, but through the change of size and proportion, a sense of hierarchy is made in unity, creating a modern and fashionable urban temperament.

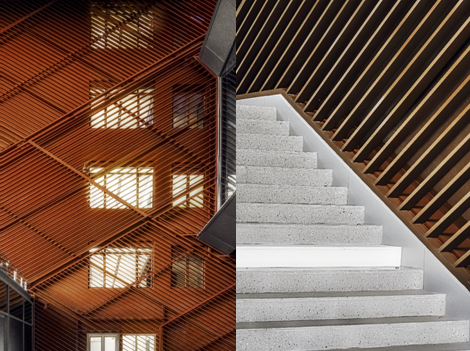

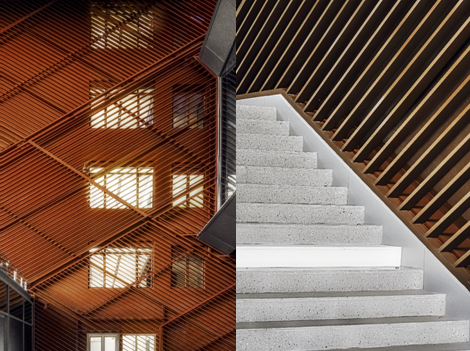

The inner wall of the atrium is made of orange grille material, which contrasts with the light-colored city facade and outlines the outline of the core. Here, enterprises can get complete supporting support, employees can relax after work, Zhejiang University students and surrounding residents can naturally step into the venue, and finally form a lively and warm community.

Inner wall of atrium with red-brown grille

Part04.

Like a college, promote the birth of creativity.

The design team told us that this place can be regarded as a "creative school".

The interior of the building is as vivid as the exterior. The design team hopes that this is a diverse and inclusive place, so the project has broken through the setting of "standard floor" and inspired creative inspiration from the diverse space. According to the plan, 1-3F here is for shops & small and medium-sized enterprises, 3-9F is for small and medium-sized enterprises, and 10-14F is for headquarters office. Each floor is not the same, so that each enterprise can have its own "exclusive personality space". How exactly is this achieved?

The building provides a 270-degree wide view through four landscape office boxes; In general office buildings, enterprises will be separated by "floors", but the high atrium strengthens the lighting and creates the possibility of eye contact; By providing planes with different areas, enterprises with different scales and development stages can be satisfied, forming a diversified enterprise composition; Some floors have also set up balcony space, that is, "Zhejiang University Observatory", which gives people positive psychological hints. Even the outdoor platform of 3F can be linked indoors, for example, providing the possibility of outdoor teaching for dance training institutions.

Left: bottom view of shared atrium; Right: landscape office box view.

Real-life map of Zhejiang University Observatory

Each floor plan is different. Examples of plans of 8F and 12F.

And architecture and space itself have also become the media of creativity. In addition to architects, designers of different categories, such as landscape, interior and vision, also use the same design language throughout, so that the "tenon and mortise elements" can be implemented on the scale of closeness and walking, and creativity can be perceived through daily behavior. The light gray large steps are embedded with wood materials with a more temperature sense, and the tenon-mortise style is continued. Even the square floor and indoor and outdoor signs are inspired by tenon-mortise elements.

Left: steps of mortise and tenon elements; Right: the floor of mortise and tenon elements.

Identification of mortise and tenon elements

Here, from the beginning, we must break through the convention and implant creativity into our daily experience.

Part05.

Like instruments, every place is ingenious.

After more than 1500 days and nights of polishing, Kaiwu Innovation Building looks like a precision instrument that can be turned on at any time. In order to put innovation into every detail, different types of work such as architecture, landscape, structure, equipment, construction and operation work together.

Night view map

For example, overcoming construction difficulties: the largest single glass weighs 1.5 tons and its size is 1.8m×9m, which is three times that of conventional glass; There are many twists and turns in the facade, and the grille is irregular. There are more than 140 installation process detail nodes in total. Reduce building energy consumption: The vertical sunshade member used in the east and west facades rotates at 45 degrees, and the interlayer aluminum plate with horizontal angle can control the sun angle. At the same time, the integrated window system is adopted to reduce the overall energy consumption. Innovative floodlight design: use the indoor self-contained lighting, through ultra-white glass (high transmittance, but low ultraviolet transmittance, common in high-end office and business), showing the effect of luminous box from the inside out.

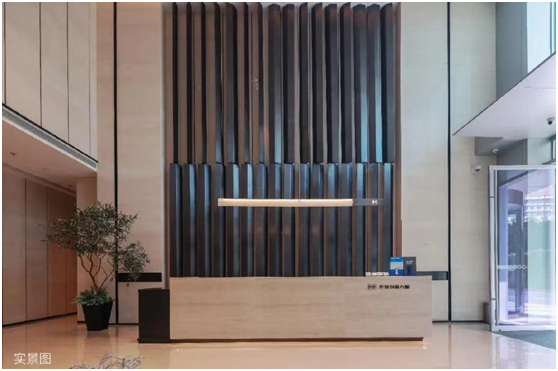

Kaiwu Innovation Building raises the lobby by about 9.6 meters to match the gas field of the corporate headquarters; Equipped with 3+1 Hitachi brand elevators, vertical commuting efficiency; About 4 meters high office standard, the scale is open and free to stretch; VRF air conditioning+fresh air system is adopted to ensure the permanent health of the office environment; About 10CM grid floor is convenient for the secondary decoration of enterprises, and the pipe arrangement and wiring are more free.

The building also hired Wanwu Lianghang, which was jointly established by Vanke Property and dtz Qiangqiang, to provide 7×24H professional commercial property services for the settled enterprises.

Real-life map of lobby

It is not difficult to find that the "new landmark" interpreted by Kaiwu Innovation Building does not stop at one or two design highlights, but innovates from the aspects of urban trends, application scenarios and low-carbon technologies, and creates a comprehensive office project with a focus on the present and a more future-oriented perspective through comprehensive upgrading of concepts, planning, space and services. In the future, the building will give play to the power of new standards in the form of innovation, connect the innovative people, resources and formats of the city, and promote the development of the region and the city.

Article source: AssBook design canteen