The company is suspected of huge fraud! Securities and futures commission strikes hard.

After Henan Xinye Textile Co., Ltd. (hereinafter referred to as "*ST Xinfang" or "Xinye Textile") was put on file by the Securities and Futures Commission on March 21st, the regulatory authorities dealt with it strictly and promptly. In just over a month, the case quickly ushered in new progress.

*ST Xinfang announced on the evening of April 28th that the company received the Notice of Administrative Punishment in advance (hereinafter referred to as the Notice) on the same day, and the company was suspected of inflating, inflating operating income, inflating operating costs, inflating inventory and inflating R&D expenses, resulting in false records in the annual report from 2016 to 2022, and it was planned to be fined 42.5 million yuan. Wei Xuezhu, then chairman of the company, and Xu Qinzhi, then director, deputy general manager, then chief financial officer and secretary of the board of directors, were proposed to be banned from the securities market.

On the same day, the company issued an announcement about the delisting risk warning of the company’s shares being superimposed. The above matters may touch the situation of major illegal forced delisting, and the company’s shares may be subject to major illegal forced delisting. The company’s shares will be superimposed to implement delisting risk warning from April 29, and the company’s shares do not need to be suspended.

Market participants believe that the regulatory authorities intend to punish *ST Xinfang severely and quickly, which means that the concept of strict supervision and strict management is being effectively implemented in regulatory enforcement actions, releasing a heavy signal of cracking down on financial fraud. With the continuous improvement of the level of supervision, strict supervision and management will make the offenders who tell lies, make false accounts and hide the truth "both human and financial" and make the counterfeiters "unable to escape".

Suspected of financial fraud for 7 consecutive years

According to the Notice, Xinye Textile is suspected of inflating and deflating its operating income, inflating its operating costs, inflating its inventory and inflating its research and development expenses, resulting in false records in its annual report from 2016 to 2022.

Among them, in 2016, Xinye Textile inflated its operating income by 327,573,820.56 yuan, reduced its operating cost by 176,566,869.05 yuan, inflated its research and development expenses by 145,689,276.86 yuan, and inflated its total profit by 358,451,412.75 yuan, accounting for the total profit disclosed to the public in the current period.

In 2017, Xinye Textile inflated its operating income by 415,186,873.41 yuan, reduced its operating costs by 113,588,173.09 yuan, inflated its R&D expenses by 161,430,520.00 yuan, and inflated its total profit by 367,344,526.50 yuan, accounting for 115.5% of the total profit disclosed to the public in the current period.

In 2018, Xinye Textile inflated its operating income by 791,260,794.64 yuan, inflated its operating costs by 324,203,622.72 yuan, inflated its R&D expenses by 182,711,331.72 yuan, and inflated its total profit by 284,345,840.20 yuan, accounting for 65.77% of the total publicly disclosed profits in the current period.

In 2019, Xinye Textile inflated its operating income by 1,214,828,839.70 yuan, inflated its operating costs by 447,174,451.37 yuan, inflated its research and development expenses by 184,918,136.28 yuan, and inflated its total profit by 582,736,252.05 yuan, accounting for the total profit disclosed to the public in the current period.

In 2020, Xinye Textile inflated its operating income by 1,033,879,498.96 yuan, inflated its operating costs by 486,224,705.51 yuan, inflated its research and development expenses by 156,715,336.95 yuan, and inflated its total profit by 390,939,456.50 yuan, accounting for the total profit disclosed to the public in the current period.

In 2021, Xinye Textile inflated its operating income by 666,637,035.70 yuan, inflated its operating costs by 92,364,075.25 yuan, inflated its R&D expenses by 163,025,099.78 yuan, and inflated its total profits by 411,247,860.67 yuan, accounting for 1,013% of the total publicly disclosed profits in the current period.

In 2022, Xinye Textile inflated its operating income by 1,258,233,157.95 yuan, inflated its operating costs by 1,919,295,821.13 yuan, inflated its R&D expenses by 101,186,735.00 yuan, and inflated its total profit by 762,249,398.18 yuan, accounting for the current period.

The CSRC believes that the above-mentioned behavior of Xinye Textile is suspected of violating the provisions of Article 63 of the Securities Law of People’s Republic of China (PRC) revised in 2005 (hereinafter referred to as the Securities Law of 2005) and the second paragraph of Article 78 of the Securities Law of People’s Republic of China (PRC) revised in 2019 (hereinafter referred to as the Securities Law), which constitutes the first paragraph of Article 193 of the Securities Law of 2005 and Article 100 of the Securities Law.

The proposed fine is 42.5 million yuan.

According to the facts, nature, circumstances and social harm of the illegal acts of the parties concerned, combined with the special circumstances that the illegal acts span the application of the old and new Securities Law, and according to the provisions of the second paragraph of Article 197 of the Securities Law, the CSRC intends to impose a fine of 42.5 million yuan on the company and related responsible persons.

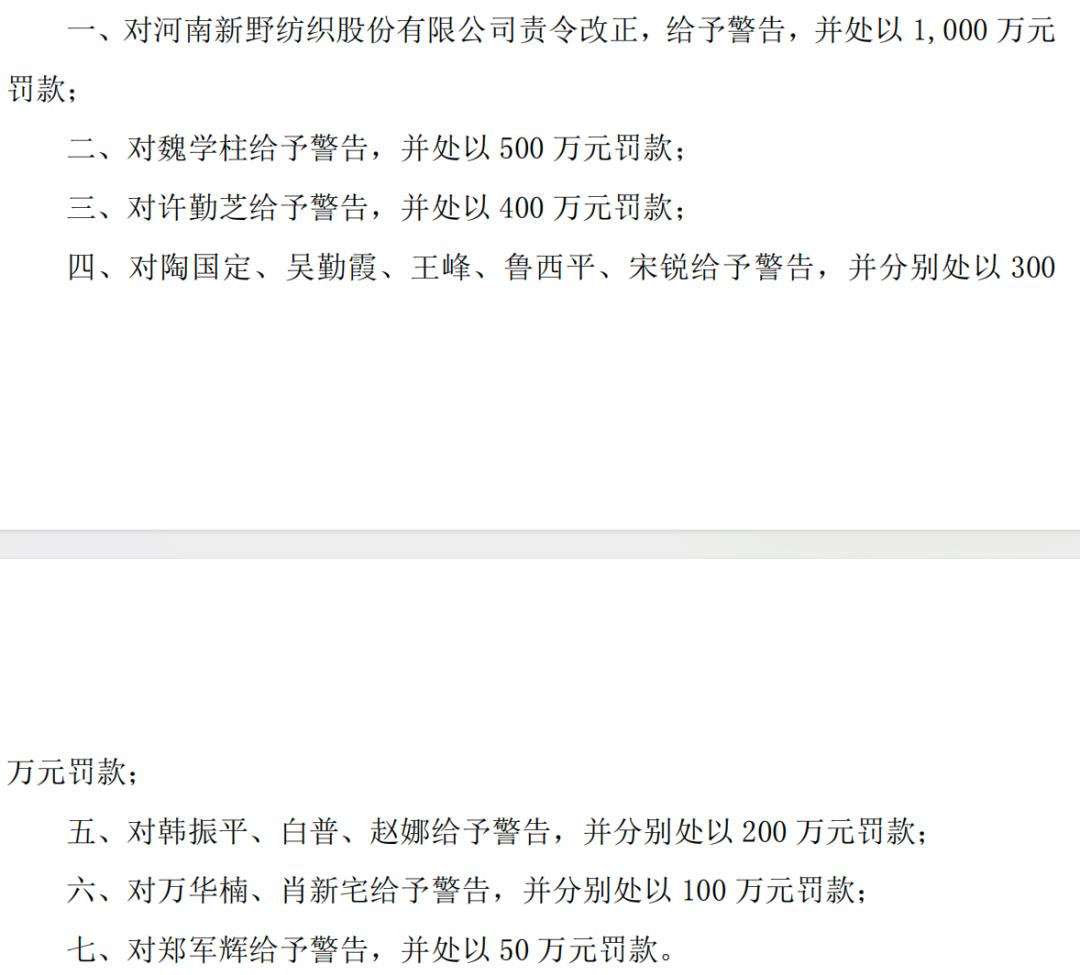

Among them, it is planned to order Xinye Textile to make corrections, give a warning and impose a fine of 10 million yuan;

It is proposed to give a warning to Wei Xuezhu and impose a fine of 5 million yuan;

It is proposed to give Xu Qinzhi a warning and impose a fine of 4 million yuan;

And impose corresponding penalties on other parties.

Image source: company announcement

Strict supervision and management, and heavy punches are also reflected in the precise attack on the "key minority." According to the Advance Notice of Administrative Punishment and Market Prohibition, Wei Xuezhu was then the chairman of Xinye Textile, and organized and planned the illegal information disclosure involving a long time and huge amount, which seriously disrupted the order of the securities market. According to the relevant regulations, the CSRC intends to decide to ban Wei Xuezhu from the securities market for life.

As director, deputy general manager, then chief financial officer and secretary of the board of directors of Xinye Textile, Xu Qinzhi organized and implemented financial fraud according to Wei Xuezhu’s instructions, and the circumstances were serious. According to the relevant regulations, the CSRC intends to decide to ban Xu Qinzhi from the securities market for 10 years.

Financial fraud touches the bottom line of the capital market and must be resolutely cracked down. Recently, the CSRC has repeatedly stressed that it will continue to strengthen the supervision of listed companies, crack down on financial fraud, illegal occupation and other illegal acts, and effectively protect the legitimate rights and interests of investors.

The responsible comrades of the relevant departments of the CSRC said that in the next step, the CSRC will strengthen joint efforts with various regions and departments to build a comprehensive punishment and prevention system to combat financial fraud, focusing on cracking down on five types of behaviors. First, long-term systematic fraud and third-party cooperation fraud, for the planners and helpers of fraud, we must seriously pursue responsibility and resolutely break the "ecological circle" of fraud. The second is the fraudulent issuance of stocks and bonds. We must resolutely keep counterfeiters out of the capital market and resolutely remove those who have mixed in. The third is the financial "bathing" behavior of abusing accounting policies and accounting estimates and adjusting profits at will. The fourth is the act of counterfeiting through financing trade, "idling" and "taking orders". Fifth, a series of fraudulent acts accompanied in the process of encroaching on the interests of listed companies and hollowing out listed companies.

Facing multiple delisting risks

It is noteworthy that the company also faces multiple delisting risks.

On the evening of April 28th, the company issued an announcement about the delisting risk warning of the company’s shares being superimposed, and the company received the Notice on the same day. According to the "Notice", it is found that Xinye Textile has illegal facts such as inflated business income, inflated business cost, inflated inventory, inflated research and development expenses, inflated profits and so on. The aforementioned matters may touch on the situation of forced delisting due to major violations of laws, and the company’s shares may be forced to be delisted due to major violations of laws. At present, the company is verifying the illegal facts and financial data of the Notice, and the final result is subject to the formal decision. The company will continue to pay attention to and disclose relevant information in time after receiving the formal punishment decision.

There are other risks of termination of listing in the company’s stock. On the evening of April 28th, the company announced that the matters that caused the company’s 2022 financial report to be unable to express opinions by audit institutions included: correction of accounting errors in the previous period, major defects in internal control of financial reports, and major uncertainties related to going concern. The company’s 2023 annual financial report is intended to be issued by the audit institution with non-standard opinions, thus touching the delisting situation.

At the same time, according to the relevant regulations, listed companies that only issue A shares in Shenzhen Stock Exchange will be terminated if the daily closing price of their shares is lower than that of 1 yuan for 20 consecutive trading days. As of the disclosure date of this announcement, the closing price of the company’s shares has been lower than that of 1 yuan for 18 consecutive trading days. If the closing price of the company’s shares is lower than that of 1 yuan for 20 consecutive trading days, the company’s shares will be terminated from listing, and investors will be reminded to pay attention to investment risks.

Up to now, the company has not disclosed the 2023 annual report. According to the suggestive announcement issued by the company on April 26 on delaying the disclosure of the 2023 annual report, the 2023 annual report of the company postponed the disclosure date to April 30. According to the company’s announcement on April 28th, the company’s 2023 annual financial report is intended to be audited by an audit institution with non-standard opinions, thus touching the delisting situation. From this calculation, the company may first touch the financial delisting index.

"The above-mentioned cases have released the heavy signal that the CSRC insists on cracking down on financial fraud. Through this case, we find that securities supervision and law enforcement is by no means a "three cups of fines", let alone a "break the money to avoid disaster" and get rid of it once. It will help to rebuild a good market ecology by attacking counterfeiters who try their own laws and hitting "don’t dare to do it again", which will make them learn a lesson and remember for a long time, especially for vicious illegal acts such as financial fraud. Lv Chenglong, an associate professor at Shenzhen University Law School, thinks.

Lv Chenglong also said that at present, with the start of a new round of delisting reform, the number of "delisting contacts" for financial fraud has increased. Among them, the revision of the delisting rules proposes to strictly apply the scope of major illegal delisting, lower the threshold for two years of financial fraud to trigger major illegal delisting, and add one year of serious fraud and years of continuous fraud delisting. "In the future, these measures will help build a safe, standardized, transparent, open, dynamic and resilient capital market." Lv Chenglong said.