An Insight Report on the Trend of Tourism Consumption in China in Q1, 2024: Everything is growing and the tide is surging.

The Insight Report on Tourism Consumption Trends in China in Q1 2024, jointly launched by Global Travel News and Global Travel News, was officially released recently.

Highlights of this report:

▲ The overall willingness to travel has been strengthened, and young people have become the main force of tourism.95.51% of the respondents plan to travel in 2024, an increase of 3.66 percentage points over last year. Young people (23-40 years old) account for the highest proportion in all kinds of travel modes.

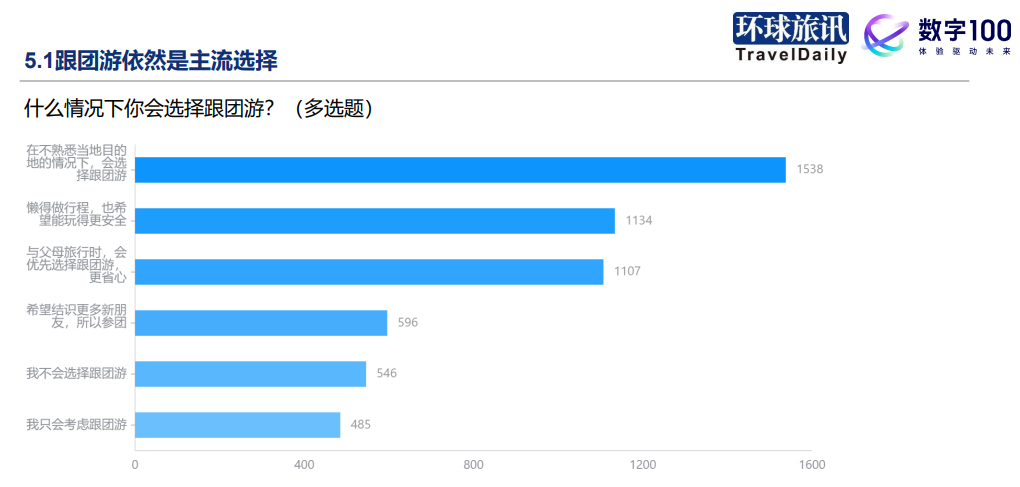

▲ Tradition goes hand in hand with group tour and emerging self-help tour.About 90% of the respondents will choose to travel with a group for various reasons, including unfamiliarity with the destination, travel safety and other concerns. But they also have a strong demand for self-help experience, leaving some free time to arrange.

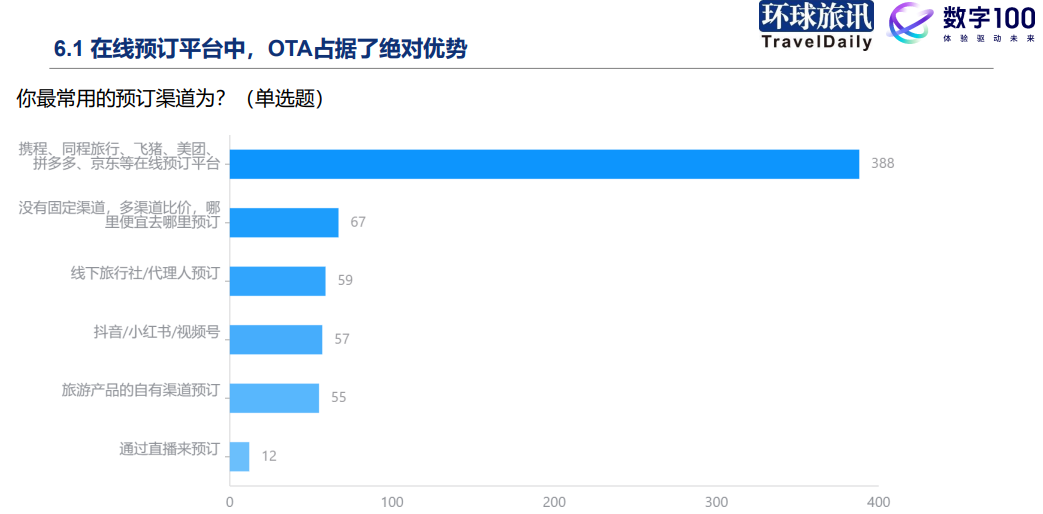

▲ OTA still occupies an overwhelming channel advantage, but its service pain points still need to be improved.Over 60% of the respondents choose OTA booking, but they have many concerns about customer service and after-sales service.

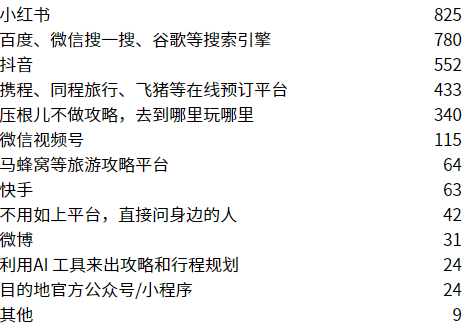

▲ Xiaohongshu has become the new favorite of travel raiders, and the traditional raiders platform has declined.In the stage of tourism planning, nearly 25% of the respondents thought of Xiaohongshu as the first strategy channel, followed by Tik Tok and search engines, and the influence of the traditional tourism strategy platform dropped significantly. However, there are also 10% respondents who choose not to do raiders and travel casually. Holiday economic effect, grass planting effect and cost performance have become the main driving forces of impulsive tourism consumption.

01

Increased willingness to travel

Going further away.

On the whole,Compared with the actual scale of last year’s travel, respondents have a larger plan for this year’s travel.91.85% of the respondents had travel experience in 2023; Looking forward to 2024, 95.51% of the respondents plan to increase by 3.66 percentage points year-on-year.

Consumers’ willingness to travel has not only increased significantly, but also the proportion of respondents who plan to travel many times during the year is as high as 1/3. It seems that the pace of tourists will go further this year, and the number of people planning to travel across provinces is 1.77 times that of Zhou Bianyou in the province.

The report results show that:Young people have become an unstoppable main force in tourism consumption.The proportion of young and middle-aged consumers aged 23-40 is the highest, no matter whether they travel to Zhou Bianyou in the province or across provinces in China, or Japan, South-East Asia for short-distance trips, or Europe and America for long-distance international trips.

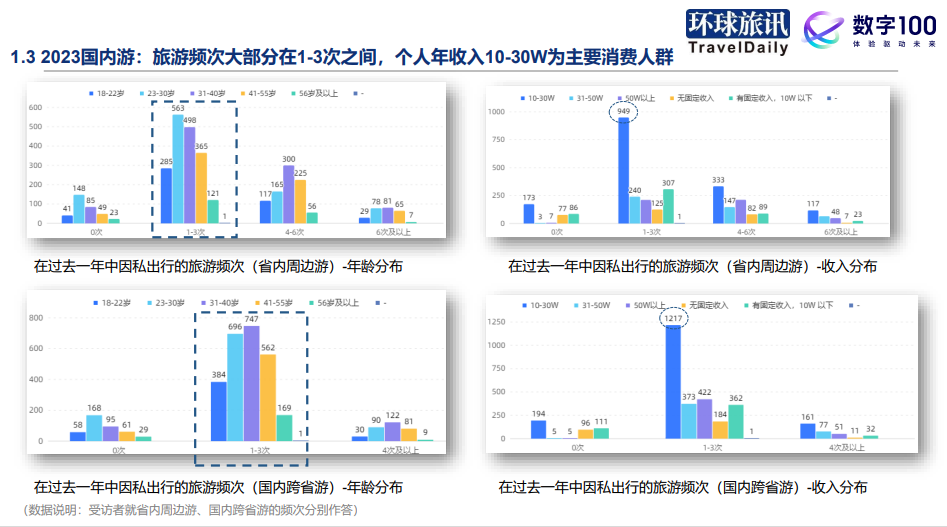

as soon asDomestic private travelGenerally speaking, most of the interviewees have traveled 1-3 times in the past year, and their personal annual income is also concentrated in the range of 100,000-300,000.

In terms of outbound tourism, the annual personal income also has a significant impact on the frequency of short-term trips to Japan, South Korea/Southeast Asia or long-term trips to Europe and America.

02

Old and new models go hand in hand

"Silver-haired people" have risen suddenly.

Among the respondents who traveled abroad in 2023, the vast majority of people with an annual income of 100,000-300,000 yuan have only been to the above-mentioned outbound destinations once; Among the higher-income groups with an annual income of 500,000 yuan, the proportion of people who visited the above-mentioned outbound destinations twice or more last year was significantly higher than that of those who only visited once.

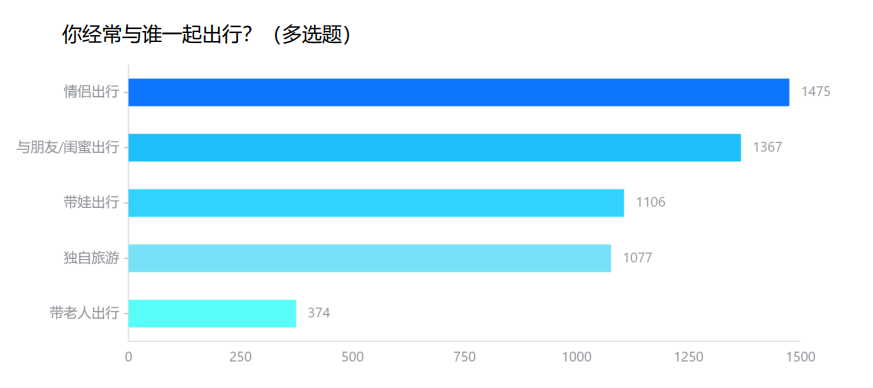

Judging from the more detailed collocation of travelers, the tourism market presentsTraditional socialization and emerging independence go hand in hand.

On the one hand, the total proportion of peers in traditional intimate relationships (lovers/friends/family) is still the highest; On the other hand, in recent years, the trend of social singleness and low fertility rate has also spawned a large number of demand for solo travel.

The traditional social needs of consumers in the process of traveling are remarkable, which is also reflected in the survey results of group tours in the report.

This survey shows that about 90% of the respondents will choose to travel with a group for various reasons, among which the main reasons include: unfamiliar with the destination, worrying about the safety and efficiency of the trip. These concerns of consumers are particularly prominent when traveling abroad.

For outbound travel, respondents prefer to travel with a group, but at the same time, they expect to be a little free and easy in the itinerary of the tour group, hoping to set aside some time to arrange their own itinerary. Especially inShort-distance overseas destinations, such as Southeast Asia and Japan, pay more attention to the degree of freedom of travel and tend to choose free/semi-free travel.In contrast, price is not the main concern for outbound tourists.

There are also sub-groups that are not so "price-sensitive", and in recent years.A sudden emergence of "silver-haired" tourists. In the past, many of them were unfamiliar with online ecology and relied more on the help of younger generations to join group tours. Today, this trend seems to have changed.They are increasingly making travel decisions independently.

About 10.3% of the respondents said that their parents are now more inclined to arrange their own trips without relying on their children. In fact, this corresponds to a new generation.The retired elderly with high knowledge and high consumption power have begun to enter the tourism market, which also puts forward higher requirements for the current iteration of tourism products for the elderly.In the past, the way of attracting elderly consumers only by low-priced groups was obviously out of date.

03

The traditional raiders platform is weak.

Xiaohongshu pressed Tik Tok.

In the stage of users’ pre-departure planning, nearly 25% of the 3,302 people interviewed this time thought of using little red books as a strategy first, followed by various search engines (23.6%), Tik Tok (16.7%) and OTA platform (13.1%) ranked third and fourth respectively. This not only shows thatThe influence of emerging channels such as Little Red Book and Tik Tok on users’ initial tourism planning should not be underestimated, which also shows that traditional search engines still have a place in consumers’ minds.

On the other hand, we can also see that,The traditional travel strategy platform is gradually declining, and its sense of existence in consumers’ minds is even weaker, and its position has even lost to the OTA platform, which was originally the main reservation function.

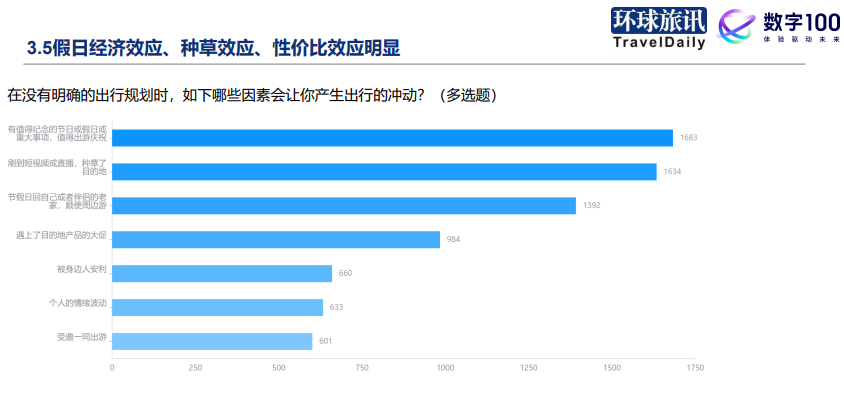

Moreover, there are many people who don’t do raiders at all and travel willfully, accounting for more than 10%. For this group of people, there are many reasons for their impulsive tourism consumption, butThe three biggest influencing factors are holiday economic effect, grass planting effect and cost-effective effect.

Nowadays, many young people pay attention to being kind to themselves and pleasing themselves. Under this premise, where are tourism consumers more willing to spend money? I believe this is also the concern of most tourism brands and service companies. This survey shows that among the respondents who choose to travel freely or semi-freely, they tend to beInvest more budget in local eating and drinking, accommodation and local play experience.

04

OTA "it is difficult to cross the mountain"

Dark horses emerge in destination play

Although the status of "half of the country" with the group tour is solid, there are also many passengers who are unwilling to join the group and choose to "customize themselves". For this group,OTA booking channel still occupies an overwhelming advantage, which is the "insurmountable mountain" for competitive booking channels.Online booking platforms such as,, and account for more than 60%.

In contrast, Tik Tok/Little Red Book and the like.At present, the main battlefield of tourism and grass planting is not a common booking channel for most consumers.The proportion of respondents is only 9%.

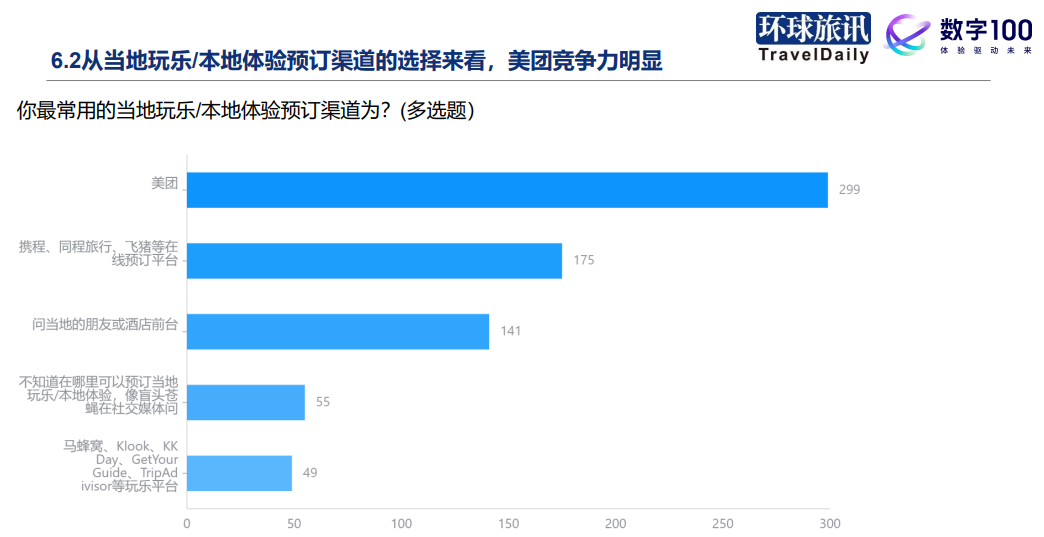

specificAs a strong player in local life, it is even more important to book the destination fun.About 41.6% of the respondents chose Meituan, which far exceeds other OTA platforms and Klook, which is their main destination booking platform.

This survey also saw the advantages and pain points of the online booking platform.

Regarding the advantages of OTA, 34.16% of the respondents believe that it is the function of price comparison, while 21.89% of the respondents value the convenience of instant payment more. In recent years, various AI-related functions have been rolled up, at least not yet forming an advantage effect in consumers’ minds.

In terms of disadvantages, OTA is more criticized for its service pain points. Many interviewees’ concerns focus on the mechanical handling of customer service, being offline, and even worrying that there is no after-sales service.

Click to view the annual selection report collection.

Click to buy the full report.