Five pictures to understand the annual report cards of the three giants of home appliances

[annual report analysis]Gree Electric, Midea Group and Haier Zhijia, the three giants of home appliances, have released their 2020 financial reports one after another. It also allows investors to comprehensively compare the "transcripts" of the three giants last year.

Comparison of income and profit

The income and profit are still the same, and Midea Group has won the double champion. Midea Group achieved a revenue of 285.7 billion yuan last year, a year-on-year increase of 2.27%; The net profit attributable to shareholders of the parent company was 27.223 billion yuan, a year-on-year increase of 12.44%. Midea Group’s revenue has been growing in single digits for three consecutive years from 2018 to 2020, but its net profit has maintained double-digit growth, which is also commendable.

Gree Electric achieved a revenue of 170.5 billion yuan last year, down 15% year-on-year; The net profit attributable to shareholders of the parent company was 22.175 billion yuan, a year-on-year decrease of 10.21%. Both revenue and net profit are double-digit refinement.

Gree Electric’s income declined for the first time in many years, but its net profit declined for two consecutive years, which also made Gree Electric give up the throne of the first profit in the home appliance industry. In 2019, Midea Group’s net profit returned to its mother was 24.2 billion yuan, lower than Gree Electric’s 24.7 billion yuan.

Haier Zhijia achieved a revenue of 209.7 billion yuan last year, a year-on-year increase of 4.46%; The net profit attributable to shareholders of the parent company was 8.877 billion yuan, a year-on-year increase of 8.2%. For Haier Zhijia, after its income surpassed that of Gree Electric in 2019, its income surpassed that of Gree Electric again last year. But the net profit is much less than that of Gree Electric.

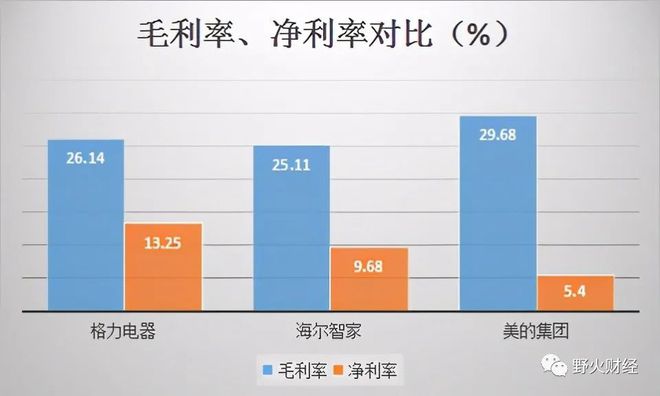

Comparison of gross profit margin and net interest rate

Although Midea’s group income is 100 billion yuan more than that of Gree Electric, its net profit is only about 5 billion yuan more than that of Gree. Haier Zhijia’s income is nearly 40 billion yuan more than that of Gree Electric, but its net profit is less than half that of Gree Electric, which is related to the gross profit margin.

Last year, the gross profit margin of Gree Electric’s sales was 26.14% and the net profit margin was 13.25%. Compared with 2019, the gross profit margin was reduced by about 1.44 percentage points, but the net profit margin increased by 0.72 percentage points.

Midea Group’s gross sales margin is 25.11% and its net sales profit rate is 9.68%. Compared with Gree Electric, Midea Group’s gross profit margin is about 1 percentage point lower, but its net profit rate is 4.57 percentage points lower.

Haier Zhijia’s gross profit margin is 29.68% and its net profit margin is 5.4%. Among the three giants of home appliances, Haier Zhijia’s gross profit margin is even the highest. Why is the net profit rate the lowest?

It is related to four expense rates, namely, sales expenses, management expenses, financial expenses and R&D expense rates. The data shows that the sum of these four expense rates of Haier Zhijia is 27.94%; Midea’s group rate is 19.03%; Gree Electric’s rate is 15.74%, which is much lower than Haier Zhijia and Midea Group.

Comparing the sales rates with the largest proportion, Gree Electric is 7.65%, Midea Group is 9.63%, and Haier Zhijia is 16.04%, which is more than twice that of Gree Electric. In other words, last year, the sales expenses of Gree Electric and Midea Group were 13 billion yuan and 27.5 billion yuan respectively, while the sales expenses of Haier Zhijia were 33.6 billion yuan.

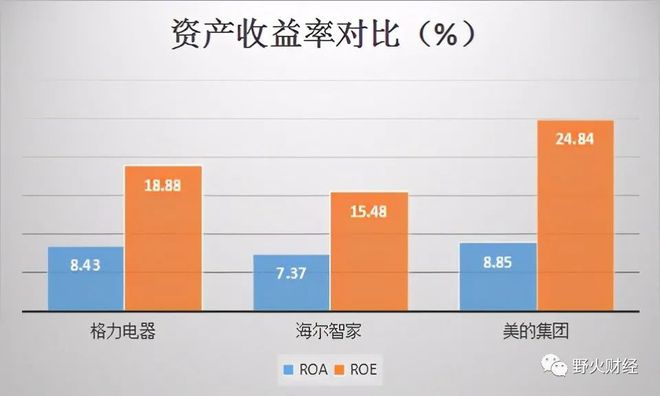

Comparison of return on assets and price-earnings ratio

Return on assets is divided into return on total assets (ROA) and return on equity (ROE). ROA in Gree Electric last year was 8.43%, and the average ROE was 18.88%.

Midea Group’s ROA was 8.85% last year, with an average ROE of 24.84%. Haier Zhijia is 7.37% and 15.48% respectively. Similarly, Midea Group takes the lead, followed by Gree and Haier.

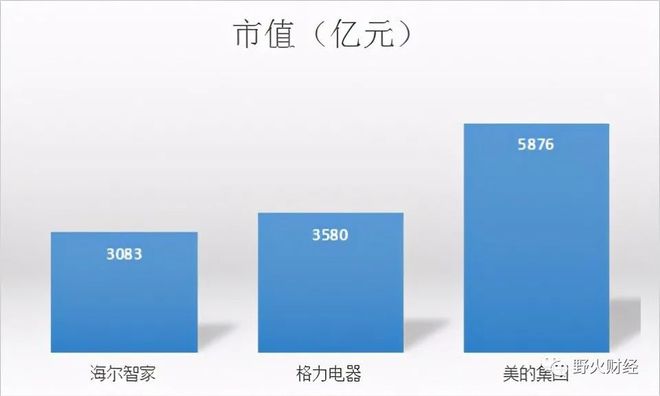

Before the market opened on April 30, Midea Group’s price-earnings ratio PE(TTM) was 24 times, and its market value was 587.5 billion yuan. Gree Electric PE is 15 times, with a market value of 358 billion yuan; Haier Zhijia PE is 35 times, and its market value is 308.3 billion yuan, which is pressing Gree Electric.

Although Haier Zhijia has the lowest market value, the market gives it a higher valuation, even more than double that of Gree Electric. In terms of the total market value, Midea Group still holds the throne of "Home Appliances One Brother".